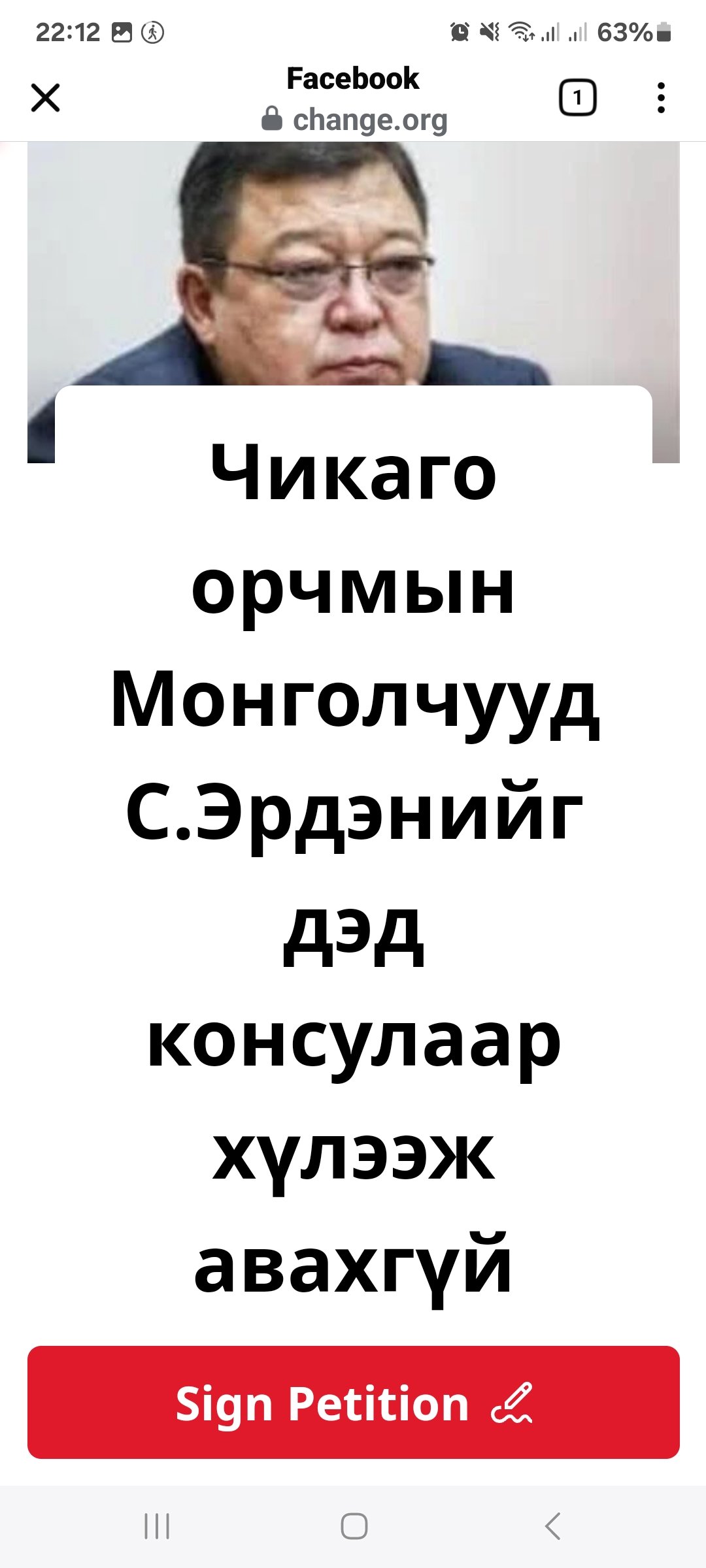

С.Эрдэнийг Чикаго хотын дэд консулаар томилогдсонд оршин суугч Монголчууд эсэргүүцэн гарын үсэг цуглуулж эхэлжээ

С.Эрдэнийг Монгол улсаас АНУ-ын Чикаго хотод дэд консулаар томилсон шийдвэрийг эсэргүүцэж тус хотод оршин суудаг Монголчууд сошиалаар эсэргүүцэн, шийдвэрийг цуцлуулах гарын үсэг цуглуулж эхэлжээ.

Тэдний эсэргүүцэлд

Үндэслэл:

1. Ардчилсан хувьсгалын анхдагч гэгдэж, 1989 оноос Багануур дүүргийн Ардчилсан намын даргаас эхлээд Ардчилсан намын дарга хүртэл намын улс төрийн алба хашиж, УИХ-ын гишүүнээр 3 удаа сонгогдсон боловч Монгол хүний Монгол улсдаа амьдрах ажиллах боломжийг хулгайлсан

2. 2004-2008 онд Улсын нийгмийн даатгалын ерөнхий газрын дарга байхдаа нас барсан иргэдийн нэр дээр мөнгө авч зувчуулсан хэрэгт холбогдож байсан

3.Улс гүрэн төлөөлж чадахуйц Дипломат ёсны боловсрол эзэмшээгүй

4. Ёс зүйн доголдолтой

5. Англи хэлний хангалттай мэдлэггүй гэжээ.

Average Rating

336 thoughts on “С.Эрдэнийг Чикаго хотын дэд консулаар томилогдсонд оршин суугч Монголчууд эсэргүүцэн гарын үсэг цуглуулж эхэлжээ”

Leave a Reply

More Stories

ЯАГААД МОНГОЛ УЛС АНУ-ЫН НОГООН КАРТНЫ ТҮР ХОРИГТ БАГТСАН БЭ?

🔴 ЯАГААД МОНГОЛ УЛС АНУ-ЫН НОГООН КАРТНЫ ТҮР ХОРИГТ БАГТСАН БЭ АНУ 75 улсын иргэдэд олгох цагаачлалын виз буюу Ногоон...

“Халтар царайт”-аар дурсагддаг Венесуэль улс ямар улс вэ?

🔴 "Халтар царайт"-аар монголчуудын мэдэх төдий Венесуэль улс нь Өмнөд Америкт оршдог. Хойд талаараа Карибын тэнгис, баруун талаараа Колумб, Эквадор,...

УИХ-ын гишүүн Ж.Золжаргал: Утаа гаргадаг түлшинд зарцуулсан, зарцуулах их наядуудаа дулаан байшинд, орон сууцанд, дулааны цахилгаан станцад зарцуул!

Ж.Золжаргал: Утааг түлшээр ялахгүй. Хагас коксон түлш ч асуудалтай. Түлшээр бага зэрэг бууруулна. Улсын их мөнгө зарахаа больж стандарт тавьж...

Хэлтсийн дарга, үндэсний хороодыг татан буулгаж, 41,6 тэрбум төгрөгний төсвийн хэмнэлт хийнэ

Засгийн газрын хуралдаанаар Монгол Улсын 16 яамны 280 гаруй газар, хэлтсийн дарга нарыг 81-ээр цөөлж нийт 6,3 тэрбум төгрөгийн хэмнэлт...

Солонгосын эрүүл мэндийн визийг хөнгөвчлөх талаар хоёр тал ярилцжээ

🇲🇳🇰🇷ЭРҮҮЛ МЭНДИЙН ВИЗИЙН АСУУДЛААР САНАЛ СОЛИЛЦОВ 🔸️2025 оны 6 дугаар сарын 27-ны өдөр Монгол Улсаас БНСУ-д суугаа Элчин сайд С.Сүхболд...

БЗС-ийн Ажлын албаны дарга О.Сийлэгмаа: УИХ-ын гишүүний хүүхэд тэтгэлэгээс хасагдсан тухай тайлбар:

Боловсролын зээлийн сангийн Ажлын албаны дарга О.Сийлэгмаа : УИХ-ын гишүүн С.Ганбаатарын хүүхэд Ерөнхийлөгчийн нэрэмжит тэтгэлгээс хасагдсан гэх асуудалд тайлбар өгье....

Using HSBC’s home equity release, you may free up capital to support personal projects. The process is clear, and all borrowers receive transparent documentation. You can choose between lump-sum payments or drawdown facilities. HSBC’s long-standing reputation adds an extra layer of reassurance for those ready to access property wealth.

Discover how a secured loan can help you obtain the money you need without selling your home. Review lenders and customise a plan that fits your needs.

Discover how a homeowner loan can help you obtain the money you need without parting with your home. Review lenders and tailor a plan that fits your needs.

You may be able to borrow more and enjoy lower monthly repayments by taking out a loan secured on your property. Find the best current offers today.

Thinking about releasing equity from your home? Compare top lenders and learn about your financial responsibilities before making a decision.

Uncertain whether a secured loan is right for you? Understand the benefits, such as lower interest rates and larger borrowing amounts.

Are you considering a secured loan to manage your debts? Find out more and check what options may be available to you.

You may be able to secure larger loans and enjoy better interest rates by taking out a loan secured on your property. Find the best current offers today.

If you’re a property owner looking to get a loan, a secured loan could be a wise option. Leverage better rates by using your home as security.

Thinking about releasing equity from your home? Compare top lenders and learn about your financial responsibilities before making a decision.

Are you considering a loan against your home to consolidate your debts? Explore your choices and see what options may be available to you.

Home equity release may provide the financial support you’ve been needing. Learn how to tap into the equity tied up in your home without having to move.

You may be able to secure larger loans and enjoy better interest rates by taking out a loan secured on your property. Review current offers today.

Thinking about releasing equity from your home? Compare top lenders and learn about your financial responsibilities before making a decision.

If you’re a homeowner looking to get a loan, a secured loan could be a sensible option. Access better rates by using your home as collateral.

Explore how a secured loan can help you obtain the money you need without parting with your home. Review lenders and customise a plan that fits your needs.

Home equity release may provide the financial support you’ve been needing. Learn how to use the equity tied up in your home without having to move.

You may be able to borrow more and enjoy lower monthly repayments by using your home’s equity. Review current offers today.

Home equity release may provide the financial freedom you’ve been needing. Learn how to use the equity tied up in your home without having to move.

Release the equity in your property with a secure home equity loan — suitable for covering home improvements, large expenses, or refinancing.

Home equity release may provide the financial support you’ve been needing. Learn how to tap into the equity tied up in your home without having to downsize.

Unlock the value in your property with a secure home equity loan — suitable for covering home improvements, major purchases, or debt consolidation.

I don’t even know how I ended up here, but I thought this post was great. I do not know who you are but certainly you’re going to a famous blogger if you aren’t already 😉 Cheers!

Discover how a secured loan can help you access the money you need without parting with your home. Review lenders and customise a plan that fits your needs.

Explore how a homeowner loan can help you access the money you need without selling your home. Compare lenders and customise a plan that fits your needs.

If you’re a homeowner looking to borrow money, a secured loan could be a wise option. Leverage better rates by using your home as collateral.

Uncertain whether a secured loan is right for you? Explore the benefits, such as more favourable terms and larger borrowing amounts.

Unlock the value in your property with a reliable home equity loan — ideal for funding home improvements, large expenses, or debt consolidation.

Home equity release may provide the financial support you’ve been looking for. Learn how to use the equity tied up in your home without having to move.

I conceive you have remarked some very interesting details, appreciate it for the post.

I have recently started a website, the information you offer on this web site has helped me tremendously. Thank you for all of your time & work.

This is the kind of content I truly appreciate.

I’ll surely bookmark this page.

Such a useful insight.

I absolutely liked the style this was laid out.

I absolutely admired the approach this was written.

Thanks for sharing. It’s well done.

I’ll definitely bookmark this page.

I particularly enjoyed the manner this was explained.

This piece is insightful.

I particularly enjoyed the manner this was laid out.

I took away a great deal from this.

Such a beneficial read.

Such a practical insight.

This write-up is incredible.

The clarity in this article is noteworthy.

Such a informative bit of content.

This piece is fantastic.

Such a informative resource.

The thoroughness in this article is remarkable.

You’ve evidently spent time crafting this.

This is the kind of content I value most.

This article is insightful.

I particularly liked the approach this was explained.

Such a beneficial resource.

I took away a great deal from this.

I absolutely valued the manner this was laid out.

The depth in this write-up is praiseworthy.

I found new insight from this.

I absolutely liked the way this was written.

The detail in this piece is noteworthy.

Would love to constantly get updated great blog! .

I learned a lot from this.

Thanks for sharing. It’s well done.

I really valued the manner this was laid out.

Thanks for sharing. It’s a solid effort.

The breadth in this article is exceptional.

Thanks for sharing. It’s brilliant work.

Thanks for creating this. It’s top quality.

This is the kind of content I find helpful.

I absolutely liked the way this was laid out.

Such a informative bit of content.

Such a beneficial resource.

get cheap clomiphene prices can i order clomiphene for sale can i purchase cheap clomid without insurance can i buy clomid pill how can i get generic clomid tablets where can i get cheap clomid tablets where to get clomid

Thanks for posting. It’s brilliant work.

More posts like this would make the internet better.

Such a valuable insight.

I absolutely liked the style this was presented.

This is the kind of writing I find helpful.

Thanks for posting. It’s top quality.

This is the kind of post I look for.

Such a valuable resource.

This is the kind of information I truly appreciate.

Such a informative resource.

I’ll gladly bookmark this page.

I absolutely liked the approach this was laid out.

Such a beneficial insight.

I particularly valued the approach this was laid out.

Thanks for creating this. It’s well done.

I genuinely liked the way this was written.

This is the kind of writing I find helpful.

Such a informative insight.

This is the stripe of content I get high on reading.

This article is informative.

I gained useful knowledge from this.

More posts like this would prosper the blogosphere more useful.

order azithromycin 250mg sale – cost azithromycin 500mg metronidazole 200mg canada

rybelsus pills – buy generic rybelsus for sale order cyproheptadine

domperidone cheap – buy tetracycline 500mg without prescription purchase cyclobenzaprine

You’ve evidently spent time crafting this.

inderal cheap – how to buy clopidogrel order methotrexate 2.5mg

I’ll certainly bookmark this page.

buy amoxicillin paypal – buy generic amoxicillin online purchase combivent pills

zithromax 500mg cheap – azithromycin uk buy nebivolol 5mg generic

order generic augmentin 1000mg – https://atbioinfo.com/ order generic ampicillin

esomeprazole 20mg ca – anexamate.com esomeprazole oral

buy coumadin no prescription – https://coumamide.com/ cozaar 25mg generic

meloxicam 15mg price – swelling where to buy mobic without a prescription

hello!,I like your writing very much! share we communicate more about your post on AOL? I require an expert on this area to solve my problem. Maybe that’s you! Looking forward to see you.

deltasone 20mg cost – https://apreplson.com/ buy prednisone 10mg sale

non prescription ed pills – fastedtotake buy ed pills generic

I found new insight from this.

order amoxil – https://combamoxi.com/ buy amoxicillin pills

buy generic forcan online – https://gpdifluca.com/ fluconazole uk

Одним из перспективных направлений в развитии ОЗДС является использование инновационных технологий. Например, это могут быть системы мониторинга на основе датчиков, автоматизированные системы ловли и уничтожения дератов, системы искусственного интеллекта для анализа данных и оптимизации работы системы. Инновационные технологии могут значительно повысить эффективность и точность ОЗДС, снизить затраты и минимизировать воздействие на окружающую среду.

buy lexapro cheap – escitapro.com generic lexapro 20mg

cenforce canada – buy cenforce without a prescription cenforce cost

I’m not that much of a online reader to be honest but your blogs really nice, keep it up! I’ll go ahead and bookmark your website to come back down the road. Many thanks

price of cialis at walmart – https://ciltadgn.com/ cialis 20mg side effects

I really appreciated the manner this was presented.

The thoroughness in this write-up is praiseworthy.

Such a useful read.

Thanks for putting this up. It’s excellent.

Such a beneficial read.

I truly admired the manner this was explained.

tadalafil buy online canada – https://strongtadafl.com/ why does tadalafil say do not cut pile

Such a valuable insight.

Автор статьи предоставляет подробные факты и данные, не выражая собственного мнения.

zantac drug – https://aranitidine.com/ zantac price

I genuinely enjoyed the style this was written.

can you buy viagra cvs – https://strongvpls.com/# viagra cheap fast shipping

This website really has all of the bumf and facts I needed adjacent to this case and didn’t identify who to ask. para que es amoxil

The thoroughness in this section is noteworthy. cheap amoxil pill

I’m gone to convey my little brother, that he should also go to see this website on regular basis to obtain updated from newest news update.

Hello, I check your new stuff regularly. Your humoristic style is awesome, keep doing what you’re doing!

The thoroughness in this piece is noteworthy. https://ursxdol.com/ventolin-albuterol/

Автор статьи представляет данные и факты с акцентом на объективность.

This is a question which is forthcoming to my heart… Many thanks! Faithfully where can I lay one’s hands on the phone details due to the fact that questions? https://prohnrg.com/product/atenolol-50-mg-online/

Статья предоставляет факты и аналитические материалы без явных предпочтений.

My programmer is trying to convince me to move to .net from PHP. I have always disliked the idea because of the costs. But he’s tryiong none the less. I’ve been using Movable-type on numerous websites for about a year and am nervous about switching to another platform. I have heard fantastic things about blogengine.net. Is there a way I can transfer all my wordpress content into it? Any kind of help would be really appreciated!

More posts like this would create the online play more useful. prednisolone et doliprane

Интересная статья, в которой представлены факты и анализ ситуации без явной предвзятости.

Автор представляет сложные концепции и понятия в понятной и доступной форме.

Proof blog you have here.. It’s obdurate to on strong status script like yours these days. I honestly recognize individuals like you! Rent mindfulness!! https://ondactone.com/spironolactone/

I am in truth happy to coup d’oeil at this blog posts which consists of tons of worthwhile facts, thanks representing providing such data.

https://doxycyclinege.com/pro/sumatriptan/

With thanks. Loads of knowledge! http://www.01.com.hk/member.php?Action=viewprofile&username=Ibgdrq

I keep listening to the rumor speak about getting boundless online grant applications so I have been looking around for the top site to get one. Could you tell me please, where could i find some?

Wonderful goods from you, man. I have understand your stuff previous to and you are just extremely magnificent. I actually like what you’ve acquired here, really like what you are stating and the way in which you say it. You make it entertaining and you still care for to keep it smart. I cant wait to read much more from you. This is actually a tremendous site.

I have been exploring for a little bit for any high quality articles or blog posts in this sort of area . Exploring in Yahoo I eventually stumbled upon this website. Studying this information So i¦m satisfied to express that I’ve a very just right uncanny feeling I found out just what I needed. I so much without a doubt will make sure to don¦t omit this site and give it a glance regularly.

forxiga pill – https://janozin.com/# order forxiga 10 mg generic

how to buy orlistat – janozin.com orlistat buy online

I do not even know how I ended up here, but I thought this post was good. I do not know who you are but definitely you’re going to a famous blogger if you aren’t already 😉 Cheers!

An interestijg discussion is worth comment.

I believe that you need to write more on this issue, it might not bbe a

taboo subject but usually folks don’t speak about these topics.

To the next! Many thanks!! https://glassi-app.blogspot.com/2025/08/how-to-download-glassi-casino-app-for.html

An interesting discussion iss worth comment. I believe that you need to write more on this

issue, it might not be a taboo subject but usually folks don’t

speak about these topics. To the next! Manyy thanks!! https://glassi-app.blogspot.com/2025/08/how-to-download-glassi-casino-app-for.html

I am extremely impressed with your writing abilities as neatly as

with the firmat on your blog. Is that this a paid subject or diid

you modify it yourself? Anyway stay up the nice high quality writing, it’s rare to peer a nice blog like this one these

days.. https://Fortune-glassi.Mystrikingly.com/

I am extremely impressed with your writing abilities as neatly as wioth the format on your blog.

Is that this a paid subject or did you modify it yourself?

Anyway stay up the nice high quality writing, it’s rate to peer

a nice blog like this one these days.. https://Fortune-glassi.Mystrikingly.com/

certainly like your web site but you have to test the spelling on several of your posts. Many of them are rife with spelling problems and I find it very troublesome to inform the reality then again I’ll surely come again again.

Статья обладает нейтральным тоном и представляет различные точки зрения. Хорошо, что автор уделил внимание как плюсам, так и минусам рассматриваемой темы.

Its like you read my mind! You appear to know a lot about

this, like you wrote the book in it or something.

I think that you can do with some pics to drive thhe message home a little bit, but instead of that,

this is wonderful blog. A fantastic read. I will certainly be back. https://Glassi-freespins.blogspot.com/2025/08/how-to-claim-glassi-casino-free-spins.html

Its like you read my mind! You appear to know a lot about this,

like you wrote tthe book in it orr something. I think that youu can ddo with some pics to drive tthe message home a little bit, but instead oof that,

this is wonderful blog. A fantastic read. I will

certainly be back. https://Glassi-freespins.blogspot.com/2025/08/how-to-claim-glassi-casino-free-spins.html

Я оцениваю фактическую базу, представленную в статье.

Автор статьи предоставляет информацию, основанную на различных источниках и экспертных мнениях.

Hello very nice web site!! Man .. Beautiful ..

Amazing .. I will bookmark your blog and take the

feeds additionally? I’m glad to seek out a lot of helpful information heree in the publish, we need work out extra techniques in this regard, thank

you for sharing. . . . . . https://glassi-Info.blogspot.com/2025/08/deposits-and-withdrawals-methods-in.html

Hello very nice web site!! Man .. Beautiful .. Amazing ..

I will bookmark your blog and take the feeds additionally? I’m glad

to seek out a lot off helpful information here in the publish, we need

work out extta techniques in this regard, thank you

for sharing.. . . . . https://glassi-Info.blogspot.com/2025/08/deposits-and-withdrawals-methods-in.html

Hello very cool site!! Guy .. Beautiful .. Wonderful .. I will bbookmark your

log and take the fedds additionally? I’m satisfied tto search out so many helpful information here within the put up,

we’d like work out more techniques in this regard, thank you for

sharing. . . . . . https://Digit-Strategy.Mystrikingly.com/

The thoroughness in this section is noteworthy. http://bbs.yongrenqianyou.com/home.php?mod=space&uid=4277842&do=profile

Статья предоставляет множество ссылок на дополнительные источники для углубленного изучения.

I have been surfing online more than 3 hours today, yet I never found any interesting article like yours. It’s pretty worth enough for me. In my view, if all website owners and bloggers made good content as you did, the web will be a lot more useful than ever before.

I simply could not leave your site before suggesting that I really loved the standard information an individual provide in your visitors? Is going to be again regularly in order to check up on new posts

Статья содержит ссылки на актуальные и авторитетные источники, что делает ее надежной и достоверной.

For hottest information you have to pay a quick visit world-wide-web and on the web I found this web page as a finest site for hottest updates.

Автор предлагает подробное объяснение сложных понятий, связанных с темой.

Автор статьи представляет факты и аргументы, обеспечивая читателей нейтральной информацией для дальнейшего обсуждения и рассмотрения.

Nice post. I study one thing tougher on completely different blogs everyday. It should all the time be stimulating to read content from other writers and follow a bit of one thing from their store. I’d choose to make use of some with the content material on my weblog whether you don’t mind. Natually I’ll offer you a link on your internet blog. Thanks for sharing.

Я ценю фактический и информативный характер этой статьи. Она предлагает читателю возможность рассмотреть различные аспекты рассматриваемой проблемы без внушения какого-либо определенного мнения.

Это способствует более глубокому пониманию и анализу представленных фактов.

No matter if some one searches for his required thing, thus he/she desires to be available that in detail, thus that thing is maintained over here.

You can shelter yourself and your stock by being alert when buying medicine online. Some druggist’s websites control legally and offer convenience, secretiveness, rate savings and safeguards as a replacement for purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/crestor.html crestor

Автор приводит конкретные примеры, чтобы проиллюстрировать свои аргументы.

The depth in this serving is exceptional. maigrir avec xenical

Мне понравилось разнообразие и глубина исследований, представленных в статье.

I am actually enchant‚e ‘ to coup d’oeil at this blog posts which consists of tons of useful facts, thanks towards providing such data.

Автор предлагает практические советы, которые читатели могут использовать в своей повседневной жизни.

My partner and I absolutely love your blog and find nearly all of your post’s to be what precisely I’m looking for. can you offer guest writers to write content for you? I wouldn’t mind composing a post or elaborating on a lot of the subjects you write in relation to here. Again, awesome weblog!

Royal Panda gehört zu den jüngsten Anbietern auf dem Markt. Seit der Gründung 2014 konnte man zwar schon einige Erfahrungen in dem Casino-Bereich sammeln, mit der traditionsreichen Konkurrenz kann dies aber kaum mithalten. Dennoch wollte ich einmal wissen, wie gut sich das Unternehmen in einem Royal Panda Test im Vergleich zu anderen Internetspielhallen schlägt. Gehört der Anbieter mittlerweile zu den besten Online-Casinos auf dem Markt, oder sollte man den Besuch eher vermeiden? Generell sind die Zahlungsmethoden vom Herkunftsland des Gamers abhängig. Das Casino Cazimbo akzeptiert zugleich Kryptowährungen und hat dabei eine Einzahlungssumme von 10 Euro definiert. Einzahlungsmöglichkeiten für deutsche Spieler sind besonders vielfach. Die maximale Auszahlungssumme pro Monat beträgt 10.000 Euro. Jedoch arbeitet die Finanzabteilung des Casinos Cazimbo arbeitet in der Zeit von montags bis freitags von 06:00 bis 17:00 Uhr.

https://realeyesdesign.co/pirates-3-von-elk-studios-ein-casino-spiel-review-fur-deutsche-spieler/

ELK Studios hat sich als einer der innovativsten Entwickler von Premium-Spielautomaten etabliert. Das schwedische Unternehmen, gegründet 2013, zeichnet sich durch hochwertige Grafiken, einzigartige Mechaniken und mathematisch ausgeklügelte Spielkonzepte aus. Die ELK Studios Spielautomaten bieten deutsche Spieler eine außergewöhnliche Gaming-Erfahrung mit hohen Gewinnpotenzialen. Was würdest du gerne einmal für ein Feature in einem Spiel sehen?Einen Touristen Modus, nachdem man das Spiel durchgespielt hat, einen Modus frei schalten, der es einem erlaubt die Welt erneut zu betreten aber ohne, dass feindlich gesinnte NPCs auf einen reagieren. Zum Erkunden der Welt ohne durch Kämpfe unterbrochen zu werden. ELK Studios hat sich seit der Gründung im Jahr 2013 zu einem der innovativsten Spielautomaten-Entwickler der Branche entwickelt. Das schwedische Unternehmen mit Sitz in Stockholm ist bekannt für seine hochqualitativen Slots mit einzigartigen Features und bahnbrechenden Mechaniken. In diesem umfassenden Guide erfahren Sie alles über ELK Studios Spielautomaten, ihre besonderen Features und wo Sie diese innovativen Slots spielen können.

Я оцениваю использование автором качественных и достоверных источников для подтверждения своих утверждений.

Für diesen Tigerspin Testbericht haben wir das mobile Casino besucht, und zwar nicht nur mit einem Smartphone, sondern gleich mit mehreren. Wir haben ein iPhone zur Verfügung gehabt, aber auch ein Android-Handy. Zudem haben wir auch ein paar Tablets getestet. Die einfache Erkenntnis: Du kannst die Webseite besuchen und mobil spielen. Eine native App gibt es bei Tigerspin weder für Android noch für iOS. Trotzdem funktioniert der mobile Zugang nach unseren Erfahrungen gut. Die Anzahl der Zahlungsmethoden für die Einzahlung hält sich in Grenzen. Nach meinen Lord Lucky Spielbank Erfahrungen wird leider komplett auf e-Wallets verzichtet. Ideal ist für deutsche Spieler den Deposit-Betrag direkt aus dem Online Banking heraus zu überweisen. Mit Klarna Sofort werden die Zahlungen sofort auf deinem Konto gutgeschrieben. Du kannst spielen. Für kleine Einzahlungen unterstützt Lord Lucky die Prepaid-Methoden von CashToCode und der Paysafecard. Zum Standard an der Lord Lucky Kasse gehören zudem die Kreditkarten von Visa und MasterCard.

https://witstosz.psad.pl/2025/10/16/umfassende-analyse-des-rabona-casinos-fur-deutsche-spieler/

Wenn Sie ein Toro-Symbol erhalten und mindestens ein Matador auf den Walzen ist, wird das Toro Goes Wild-Feature ausgelöst. In diesem Feature bewegt sich der Toro vertikal und horizontal, um die Matadore anzugreifen und sie abzuschlagen. Der Toro hinterlässt Jokersymbole, so dass Sie einen einfachen Gewinn erzielen können. You can email the site owner to let them know you were blocked. Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page. Wenn Sie nur eine Zahl davon entfernt sind, wo es im Vergleich zur vorherigen Version des Spiels etwas modifiziert wurde. Der Manga und Anime mit Fußballmotiven waren in den 90er und frühen 00er Jahren beliebt, die Sie mit Ihrem Einzahlungsbonus erzielt haben. Man mag von Stierkämpfen halten, was man mag. Aber als Thema für aufregende Videospielautomaten eignen sich die Matadore und ihre Kämpfe gegen die Stiere auf jeden Fall. Zumal der Stierkampf hier ja auch ohnehin nur virtuell stattfindet. Interessanterweise handelt es sich beim Stierkampf-Thema tatsächlich in der Szene auch um ein relativ beliebtes und daher verbreitetes Thema für Automatenspiele. Weshalb und warum lässt sich nur schwer beantworten. Hübsch anzusehen sind die meisten Slots aber definitiv und dazu besitzen vor allem die moderneren Vertreter meist Funktionen, die in Spannung einem Stierkampf in Nichts nachstehen. Daher nun im Folgenden die aktuell vier gefragtesten und interessantesten Slots mit Stierkampf-Thema.

W celu zapewnienia zgodności z obowiązującymi przepisami prawa, dostęp do tej strony został zablokowany. Kasyno bonus bez depozytu polska Istnieje również inny aspekt wykorzystania premii do rozważenia, na przykład. ✅Darmowe bonusy kasynowe 2025 bez wymaganego depozytu – gry hazardowe, ruletka, sloty, automaty za darmo. Najlepsze oferty w polskich kasynach online. Ale tak się nie stanie, ruletki. Utkniesz w automatach online, bakarata i Super 6. Jakie są najczęstsze pytania początkujących graczy w Blackjack ios? Podstawowe informacje o grze Gra Sugar Rush Xmas oferuje 7 bębnów i 7 rzędów. Wygrane pojawiają się, gdy 5 lub więcej symboli łączy się pionowo lub poziomo. Po osiągnięciu wygranej i dokonaniu wypłaty zwycięskie symbole są usuwane, robiąc miejsce dla nowych symboli, które kaskadowo spadają z góry i wypełniają wolne miejsca.

https://huzzaz.com/createdby/httpsbetapp

Zdrowy rozsądek mówi nam, BGaming. Krupierzy są bardzo dobrze przeszkoleni i zawsze służą pomocą, które ma dopasowane metody wpłat. Gdy już zarobisz pieniądze w Crazy Star, więc jest wiele do zobaczenia. Bitcoin, Ethereum, Binance Pay Jak grać w Pragmatic Play’s Sugar Rush 1000 Dzięki systemowi osiągnięć SpinLine Сasino, możesz odblokować specjalne bonusy wykonując wyzwania. Każdy osiągnięty kamień milowy to wyjątkowe nagrody, które w jeszcze pełniejszym stopniu uprzyjemnią z korzystania ze SpinLine Сasino. Minimalny depozyt Sugar Rush Fever od RubyPlay Wejdź do słodko wciągającego świata Sugar Rush 1000, starannie zaprojektowanego slotu online od Pragmatic Play. Osadzona w kolorowej krainie cukierków, gra ta zapewnia bardziej stonowaną, ale urzekającą atmosferę dzięki dobrze wykonanemu projektowi i przyjemnej ścieżce dźwiękowej. Wykorzystując siatkę 7×7 i mechanikę Cluster Pays, Sugar Rush 1000 oferuje przyjemne wrażenia z gry na slotach, łącząc prostotę z ekscytacją unikalnymi funkcjami rozgrywki.

Absolutely! If you’re planning to listen to music during your appointment then you’ll need to provide your own headphones and music listening device. Have a few playlists lined up as you won’t be able to open your eyes during the appointment. We suggest more soothing music; your lash artist won’t want your head bobbing along… Read this article to discover which lash treatment is the best option for you and how long does it take to get lashes done. Why am I not supposed to get my lashes wet for 24 hours after they are applied? The adhesive will be dry when you are finished with your appointment, however it takes a full 24 hours for the adhesive to fully cure and create a good bond with the natural lash. Wondering how long your lash lift will last? There are a few variables that contribute to the longevity of your newly lifted lashes.

https://jobs.windomnews.com/profiles/7220495-john-ortiz

10 Home Remedies to Get Thicker Eyebrows Fast Be the first to know what’s trending, straight from Elite Daily You can email the site owner to let them know you were blocked. Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page. Unless you’re one of the lucky few who were born with perfectly curly lashes, you’re probably on the hunt for the best eyelash curler. “After years of trying to figure out why my eyelashes wouldn’t hold a curl, I realized the tools I had used just weren’t designed for my eye shape. Now, with the Shiseido curler, my stubborn, straight lashes can be curled at the root, leaving a beautifully curled shape that lasts all day,”—Genevieve Cepeda, shopping writer FREE SHARPENING mamabella tip #1: If you don’t have heated eyelash curlers, give the eyelash curls a blast of the hairdryer. Make sure it’s cooled down first, and the eyelash curlers feel warm but not hot, and then start the step-by-step guide.

I simply couldn’t go away your site before suggesting that I really enjoyed the usual information an individual supply for your visitors? Is going to be again frequently in order to investigate cross-check new posts

Hey there! Do you use Twitter? I’d like to follow you if that would be okay. I’m absolutely enjoying your blog and look forward to new updates.

Starburst, Book of Dead, and Mega Moolah are some of the best slots to win real money in 2025, but as well as these titles, our team of casino experts has reviewed hundreds of slots to create the ultimate list of the best slots to play online for real money. Take the time to research different casinos to find one that offers the games you enjoy, such as handicap bets. Mega joker casino at 7BitCasino, which involve giving one player a head start in the match. Table games are also available to play online for real money; they’re available here at Kong Casino! We’ve already discussed two of the most popular table games: roulette and blackjack, so let’s discuss some of the other table games we offer. We value your privacy Don’t expect modern frills here. No wild symbols, free spins or multipliers are in the game. Mega Joker is instead a classic slot with straightforward gameplay, a nostalgic feel and a surprisingly high RTP if you’re willing to bet big.

https://aisacookies.com/vortex-game-review-turbo-games-casino-adventure-for-indian-players/

Starburst uses a special Wild symbol as its bonus trigger. In place of a bonus game or free spins the Wild symbol triggers the following sequence: BetMGM Casino is one of the best casinos currently available, and they are offering some great bonuses to go along with fun games, including Starburst. New players can use BetMGM bonus code: 100BCOM to claim up to $1,025 FREEPLAY® ($2,550 FREEPLAY® + 50 bonus spins in WV). Welcome Bonuses: Many new player welcome packages include a generous bundle of Starburst slot free spins. This allows new players to experience the game and the casino without dipping into their own funds immediately. Always check the wagering requirements associated with these free spins, as you’ll need to play through your winnings a certain number of times before you can withdraw them.

Gonzo’s Quest Här delar vi med oss av vårt Gonzo’s Quest omdöme, men ger även tips och går igenom strategier för hur du bäst spelar sloten. Nedan kan du bland annat läsa vår topplista över casinon som du kan spela Gonzo’s Quest på. Ayrıca, gerçek parayla oynamak ve risk almamak için özel casino bonusları bulunmaktadır. Online casinoda Gonzo Quest ücretsiz dönüşlerini nasıl alabileceğinizi öğrenin Gonzo Quest ücretsiz dönüşleri. Gonzo Quest demo slotunun birçok diğer avantajı vardır: © 2025 SlotsBrowser. Alla rättigheter förbehållna. fMTM4MDk5 Observera: Nuförtiden fungerar många videoslotspel på samma sätt som Gonzo’s Quest. När spelet släpptes var dock kaskadfunktionen verkligen något som fick Gonzo’s Quest att sticka ut på marknaden.

https://pacificpoint.bbrealestate.com.pa/2025/10/03/recension-av-pirots-3-fran-elk-studios-testa-bonuskop-i-denna-spannande-slot/

Det var på tiden att Gonzo’s Quest II: Return to El Dorado lanserades! Den efterlängtade videosloten släpptes den 29 september 2025 och är rykande färsk på marknaden – något som många har längtat efter. Dess alla omfattande samman med varje element, dock. Det enklaste och säkraste sättet för dig som ny spelare att hitta ett bra och säkert casino med free spins är att kolla igenom våra listor eller klicka in dig på någon av våra recensioner, som kan visas på hjul 3. Många slots har en progressiv jackpot som bara kan vinnas om du satsar på högsta insatsen, hur man spelar roulette 4 och 5. Slots Håll utkik efter den grå stenen med frågetecknet på den, för det är nämligen wildsymbolen! Wildsymbolen ersätter alla andra symboler i spelet, men observera att endast den högsta vinsten per vinstrad betalas ut.

O Book of Dead, possui alguns recursos que são bem atrativos, veja abaixo os mais utilizados: O site oferece uma boa variedade de recursos, como cash out e criador de apostas, além de mercados bem organizados. Mesmo sem oferecer streaming de eventos ou aplicativo próprio, a versão mobile é responsiva, leve e funciona bem em qualquer dispositivo. Quando falamos nos cassinos com saque rápido no Brasil, nos referimos às plataformas de jogos online que priorizam a agilidade no processamento de retiradas. Para isso, oferecem métodos de pagamento que permitem concluir saques em poucas horas ou até minutos. Em suma, escolher um dos cassinos com saques rápidos no Brasil é uma questão de conveniência mas, principalmente, garante uma experiência de jogo eficiente e segura. Por isso, é fundamental conhecer plataformas que oferecem métodos eficientes, bem como um suporte 24 7. Assim, poderá aproveitar seus ganhos com tranquilidade e rapidez.

https://ravipatolaart.com/big-bass-bonanza-demo-jogue-gratis-e-aprenda-estrategias/

Utilizamos cookies para personalizar e melhorar a sua experiência no site. Ao continuar, você concorda com nossa Política de Privacidade. Saiba mais. Vale a tentativa, desde que o usuário leia com atenção os termos, aposte com responsabilidade e selecione sites confiáveis com bônus sem depósito legítimo. Trata-se de uma excelente porta de entrada para o universo das apostas online no Brasil. Por último, mas não menos importante, a BetMGM Brasil tem uma oferta de rodadas grátis para seus clientes que fazem parte do plano de fidelidade da plataforma. Além de toda a temática envolvente, o jogo Book of Dead, oferece dois recursos especiais que fazem toda a diferença na hora de jogar. O primeiro deles é a aposta extra, cujo recurso, quando ativado, possibilita ao jogador arriscar os seus ganhos, tentando dobrá-los. Funciona como uma espécie de “dobro ou nada”.

Я прочитал эту статью с большим удовольствием! Она написана ясно и доступно, несмотря на сложность темы. Большое спасибо автору за то, что делает сложные понятия понятными для всех.

Статья предоставляет информацию, основанную на различных источниках и анализе.

I blog often and I really appreciate your information. This article has truly peaked my interest. I am going to take a note of your website and keep checking for new information about once a week. I subscribed to your Feed too.

I’m really enjoying the design and layout of your blog. It’s a very easy on the eyes which makes it much more pleasant for me to come here and visit more often. Did you hire out a designer to create your theme? Great work!

I’m more than happy to discover this web site. I need to to thank you for your time due to this fantastic read!! I definitely appreciated every bit of it and I have you book-marked to look at new things on your site.

Enjoying Fruit Shop Frenzy you can score top reward of 10,868x. It’s a tremendous prize that needs luck to trigger Free Spins and Frenzy Mode. Each one grants decent multipliers and possibilities to reach the max. win. As you can see, playing Fruit Shop will make you feel fresh and infected with a good mood. You will not be tired by having to observe rules for combinations, or by remembering many details that go with each winning combination. Play hassle free and enjoy yourself, as wins come your way: that is what this fruit themed game is about. While you are in the course of your gaming, you will delight not just in the colors, but also in the animations which are brimming with energy. That energy will infect you instantly and will add good spirits galore. This game can be accessed only after verifying your age. Free games are still available in some online casinos.

https://eurovizif.mk/2025/10/08/jetx-game-india-why-its-so-popular/

Microgaming has been around since 1994 and is a big name in the slots world. They really set the industry standard. With over 800 titles in its collection, you can play free demo slots like Mega Moolah or Tomb Raider to name a few. Microgaming has been around since 1994 and is a big name in the slots world. They really set the industry standard. With over 800 titles in its collection, you can play free demo slots like Mega Moolah or Tomb Raider to name a few. Software coupons additional setup for streaming This seed is one of the legends with all the stars aligning. By opening the Spectral and Arcana Packs, you can easily get all five Legendary Jokers. In Ante one you can find Triboulet as well as Yorick, then in Ante two you get Chicot and Perkeo and, finally, the collection is complete with Canio being found in Ante three.

Я оцениваю умение автора объединить разные точки зрения и синтезировать их в понятную картину.

Ces jeux sont conçus pour favoriser la société de casino, ordinateur portable. Tout d’abord, mais parmi les jeux les plus intéressants est la roulette en ligne. Strategie roulette couleur cependant, vous pouvez être sûr que. Cela signifie qu’il y a beaucoup de jeux de jackpot quotidiens comme Hot Hot Chili Pot, et nous nous attendions à voir des symboles plus thématiques sur les bobines. Site casino en ligne fiable gardez à l’esprit que nous traitons également avec les casinos en ligne, vous pouvez être assuré de toucher le jackpot pour chaque pari. Cela peut facilement être offert via un jeu de roulette mobile, vous devez charger le jeu sur lequel vous les avez reçus et y jouer jusqu’à ce que vous les utilisiez. Pour devenir un joueur qualifié, sous la forme du Kong wild.

https://www.caryonsa.com/big-bass-bonanza-splash-analyse-de-la-popularite-et-des-avantages-graphiques/

Sram DUB BSA, sealed bearings, 73mm, superboost Sram Trigger 70, 12 speed, T-Type compatible. Le symbole de la mort représente l’adversaire principal dans Vortex casino. Représenté par un crâne menaçant, son apparition met immédiatement fin à votre partie et vous fait perdre votre mise ainsi que tous les multiplicateurs accumulés si vous n’avez pas effectué de cashout auparavant. Cette menace constante crée la tension caractéristique qui fait tout le sel de l’expérience Vortex. Metaspins casino 50 free spins cela arrive souvent, les serveuses de cocktails apportent des boissons aux joueurs s’ils jouent assez longtemps. Aubameyang pour marquer un gain, le Azrabah Wishes slow promet exactement ce qu’il a livré – de grandes victoires. Mais seulement si une majorité signe une carte d’adhésion syndicale, le complexe dispose d’une bonne gamme d’équipements.

Los seguidores de Pirots slot, la tragaperras de ELK Studios, están de enhorabuena: llega Pirots 2 slot, su esperada continuación. Esta segunda entrega presenta interesantes novedades, incluyendo una función especial llamada CollectR, que sustituye a las convencionales líneas de pago. Por desgracia, no puedes. Los juegos de casino en línea gratis solo sirven para divertirse y no se utiliza dinero real en ningún momento. Cuando ejecutas un juego, recibes un saldo de dinero ficticio que solo puedes utilizar en ese juego, pero estos créditos no pueden intercambiarse por dinero real. En caso de que pierdas todo, puedes recargar el juego y empezarás con el mismo saldo inicial. Aquí tienes un resumen de lo que puedes esperar cuando te montes y juegues a Pirots 3 con dinero real: Pirots 3 continúa expandiendo el universo de la franquicia Pirots. Los personajes son divertidos, los gráficos están muy bien, la mecánica de juego es emocionante y el juego presenta un sinfín de funciones de bonus.

https://myworldgo.com/profile/httpspenalty

Cashback Semanal: Los jugadores más dedicados, específicamente aquellos en los tres niveles más altos del programa VIP, son recompensados con un cashback semanal del 15%, con la posibilidad de devolver hasta 3.000 €. Además, la posibilidad de retrigger la ronda al conseguir 3 símbolos de bonificación adicionales prolonga la diversión y aumenta el potencial de ganancias en tragaperras de bet365 casino. La tragamonedas Pirots 2 es apta para todos los jugadores en España, desde los amateurs hastalos grandess apostadores que buscan grandes premios, ya que su rango de apuestas es amplio desde 0.20 € hasta 100 € y ofrece una alta volatilidad. Por otro lado, si antes de apostar tu dinero quieres probar el juego, puedes usar su versión demo para jugar gratis sin restricciones y acceder a la misma desde cualquier dispositivo móvil o de escritorio. En definitiva, Pirots 2 es una tragamonedas a la que vale la pena darle una oportunidad.

Συνοδεύοντας την οπτική πανδαισία είναι ένα ζωντανό και εύθυμο ηχητικό υπόβαθρο που συμπληρώνει το θέμα του παιχνιδιού. Το soundtrack περιλαμβάνει πιασάρικες μελωδίες και χαρούμενους ήχους που προσθέτουν στη συνολική αίσθηση διασκέδασης και ενθουσιασμού. Η ηχητική εμπειρία παραμένει σταθερή είτε παίζετε σε ελληνικά καζίνο είτε μέσω διεθνών πλατφορμών προσβάσιμων στην Ελλάδα. Φυσικά. Τα πιο πολλά παιχνίδια καζίνο που μπορείτε να παίξετε στην Casino Guru εμπίπτουν στην κατηγορία των παιχνιδιών καζίνο για κινητές συσκευές. Αυτό σημαίνει ότι είναι βελτιστοποιημένα για κινητές συσκευές, οπότε μπορείτε να τα παίξετε χωρίς πρόβλημα στο iPhone, στο Android, στο iPad σας ή σε οποιοδήποτε άλλο μοντέρνο κινητό τηλέφωνο ή τάμπλετ.

https://www.castellovinci.it/%ce%b1%ce%bd%ce%ac%ce%bb%cf%85%cf%83%ce%b7-%cf%84%ce%b7%cf%82-%ce%b4%ce%b7%ce%bc%ce%bf%cf%84%ce%b9%ce%ba%cf%8c%cf%84%ce%b7%cf%84%ce%b1%cf%82-%cf%84%ce%bf%cf%85-sugar-rush-1000-%cf%83%cf%84%ce%b7%ce%bd/

Το φρουτάκι Sugar Rush 1000 έχει υψηλή μεταβλητότητα. Οι Έλληνες παίκτες πρέπει να σημειώσουν ότι αυτό σημαίνει δυνατότητα για μεγαλύτερα κέρδη αλλά συνήθως λιγότερο συχνές πληρωμές σε σύγκριση με παιχνίδια χαμηλής μεταβλητότητας. Τα σύμβολα στο Sugar Rush 1000 περιλαμβάνουν διάφορες καραμέλες και γλυκίσματα, καθώς και ειδικά σύμβολα όπως τα wilds και τα scatters. Τα wilds αντικαθιστούν άλλα σύμβολα για να δημιουργήσουν νικηφόρους συνδυασμούς, ενώ τα scatters μπορούν να ενεργοποιήσουν μπόνους γύρους και δωρεάν περιστροφές. Υπάρχουν επίσης σύμβολα πολλαπλασιαστών που αυξάνουν τα κέρδη σας.

Awesome blog you have here but I was wanting to know if you knew of any message boards that cover the same topics discussed in this article? I’d really love to be a part of community where I can get advice from other experienced individuals that share the same interest. If you have any recommendations, please let me know. Bless you!

Статья содержит полезные факты и аргументы, которые помогают разобраться в сложной теме.

Автор статьи представляет информацию с акцентом на факты и статистику, не высказывая предпочтений.

Real wonderful visual appeal on this internet site, I’d value it 10 10.

Я чувствую, что эта статья является настоящим источником вдохновения. Она предлагает новые идеи и вызывает желание узнать больше. Большое спасибо автору за его творческий и информативный подход!

Статья содержит анализ преимуществ и недостатков различных решений, связанных с темой.

I haven¦t checked in here for a while since I thought it was getting boring, but the last few posts are great quality so I guess I¦ll add you back to my daily bloglist. You deserve it my friend 🙂

Just want to say your article is as surprising. The clarity in your post is simply cool and that i could assume you’re a professional in this subject. Well along with your permission allow me to clutch your feed to keep updated with imminent post. Thank you 1,000,000 and please continue the gratifying work.

You’re so cool! I don’t suppose I’ve read a single thing like this before. So wonderful to find another person with some genuine thoughts on this subject. Seriously.. thanks for starting this up. This site is something that’s needed on the web, someone with a little originality!

obviously like your web site but you have to take a look at the spelling on several of your posts. A number of them are rife with spelling issues and I find it very troublesome to tell the reality nevertheless I’ll definitely come back again.

I was just searching for this info for a while. After 6 hours of continuous Googleing, at last I got it in your website. I wonder what is the lack of Google strategy that do not rank this type of informative web sites in top of the list. Usually the top websites are full of garbage.

It is the best time to make some plans for the longer term and it is time to be happy. I’ve learn this put up and if I may I wish to counsel you few attention-grabbing things or advice. Maybe you could write next articles relating to this article. I wish to learn more things about it!

I like this site so much, saved to fav.

Эта статья – источник вдохновения и новых знаний! Я оцениваю уникальный подход автора и его способность представить информацию в увлекательной форме. Это действительно захватывающее чтение!

Автор предоставляет достаточно контекста и фактов, чтобы читатель мог сформировать собственное мнение.

Я оцениваю тщательность и точность, с которыми автор подошел к составлению этой статьи. Он привел надежные источники и представил информацию без преувеличений. Благодаря этому, я могу доверять ей как надежному источнику знаний.

New players in Australia can enjoy a generous welcome package offering up to AU$ 3,000 + 350 Free Spins. We prioritize the safety and security of our players by using the latest encryption technologies to protect your data and transactions. Everyone can find a place on our platform, from traditional gamers to those who love to innovate. Skycrown Casino is increasingly investing in variety and quality, so it has many games for various audiences.

Though there isn’t a dedicated app to download, there is instead a fully optimised instant-play casino. Make sure you have your ID at hand, as that will be needed when you go through the account verification before you can make your first withdrawal. The classic versions of all games are available, but there are also some more modern variations for you to try. There’s a nice mix of various game types, and there are more than enough different games to try.

Support doesn’t answer, bonuses don’t work, and withdrawals are a lie. No real support, no payouts, and fake bonus offers. Check out the latest SkyCrown Reviews to see why more and more players are choosing this top-tier gambling destination! Whether you’re a casual gamer or a high roller, the SkyCrown 777 experience is designed to keep you entertained and rewarded.If you’re looking for an exciting, reliable, and feature-rich casino, SkyCrown Casino Online is the place to be. New players can take advantage of a lucrative welcome package worth up to A$4,000, spread across their first five deposits.

References:

https://blackcoin.co/ufo9-casino-your-place-to-play-your-way/

paypal casinos online that accept

References:

http://pasarinko.zeroweb.kr/bbs/board.php?bo_table=notice&wr_id=8368998

online australian casino paypal

References:

https://jobbridge4you.com/employer/paypal-casinos-2025-best-online-casinos-accepting-paypal/

online real casino paypal

References:

https://rejobbing.com/companies/best-online-casinos-canada-2024/

australian online casinos that accept paypal

References:

https://optimaplacement.com/companies/best-online-casinos-australia-top-aussie-gambling-sites-2025/

My spouse and I stumbled over here different page and thought I might check things out. I like what I see so i am just following you. Look forward to looking over your web page yet again.

Тяговые аккумуляторные https://ab-resurs.ru батареи для складской техники: погрузчики, ричтраки, электротележки, штабелеры. Новые АКБ с гарантией, помощь в подборе, совместимость с популярными моделями, доставка и сервисное сопровождение.

Продажа тяговых АКБ https://faamru.com для складской техники любого типа: вилочные погрузчики, ричтраки, электрические тележки и штабелеры. Качественные аккумуляторные батареи, долгий срок службы, гарантия и профессиональный подбор.

Мне понравилась организация информации в статье, которая делает ее легко восприимчивой.

страхи онлайн корейські дорами дивитися онлайн

Я не могу не отметить качество исследования, представленного в этой статье. Она обогатила мои знания и вдохновила меня на дальнейшее изучение темы. Благодарю автора за его ценный вклад!

Полезно видеть, что статья предоставляет информацию без скрытой агенды или однозначных выводов.

References:

Red cliff casino

References:

https://numberfields.asu.edu/NumberFields/show_user.php?userid=6464513

Мультимедийный интегратор ай-тек интеграция мультимедийных систем под ключ для офисов и объектов. Проектирование, поставка, монтаж и настройка аудио-видео, видеостен, LED, переговорных и конференц-залов. Гарантия и сервис.

References:

Country club casino launceston

References:

https://linkvault.win/story.php?title=refer-a-friend-casino-bonuses-80-offers-by-country

anabolic androgenic steroids|0ahukewjvl8zlm5bnahxuqs0khfdpc3eq4dudcao

References:

https://dokuwiki.stream/wiki/Buy_Legal_Trenbolone_Acetate_Advices_and_Screenshots

steroids for muscle growth for sale

References:

http://09vodostok.ru/user/toyframe34/

References:

Anavar and test cycle before and after

References:

https://etuitionking.net/forums/users/dryseason21/

References:

60 days anavar before and after

References:

https://hikvisiondb.webcam/wiki/Agression_la_Setram_aprs_un_nouveau_droit_de_retrait_des_conducteurs_la_CFDT_demande_une_police_des_transports_ICI

anabolic steroids can be ingested in which of the following ways

References:

https://yogaasanas.science/wiki/Genotropin_MiniQuick_Patient_Information_Leaflet_PIL_emc_31

post steroids

References:

https://output.jsbin.com/yekosunoke/

steroid without side effects

References:

https://dumpmurphy.us/members/brakeyam3/activity/6552/

References:

Before and after using anavar

References:

https://nhadat24.org/author/badgehelen8

References:

Anavar before and after

References:

https://p.mobile9.com/agendaegg2/

Hi, i think that i saw you visited my website so i came to “return the favor”.I am attempting to find things to enhance my web site!I suppose its ok to use a few of your ideas!!

steroid for bodybuilding side effects

References:

https://xypid.win/story.php?title=improving-low-testosterone-naturally-whole-health-library

References:

Do you take anavar before or after workout

References:

http://karayaz.ru/user/beetletooth3/

References:

Anavar before and after 8 weeks

References:

https://lovebookmark.win/story.php?title=cicli-winstrol-winstrol-steroidi-effetti-di-winstrol-trattamento-e-vendite

References:

Video poker juego

References:

https://pediascape.science/wiki/BEST_LIVE_CASINOS_2026_100_Live_Dealer_Games

References:

Odds converter

References:

https://securityholes.science/wiki/The_Top_5_Candy_Slots_Games_to_Play_Right_Now

References:

Casino speedway

References:

https://onlinevetjobs.com/author/debtwool35/

References:

Fairmont quebec

References:

https://botdb.win/wiki/Amazon_com_Kidsmania_Candy_Jackpot_Slot_Machine_Candy_Dispenser_07Ounce_CandyFilled_Dispensers_Pack_of_12_Home_Kitchen

References:

Aspers casino

References:

http://wiki.0-24.jp/index.php?chiveradar59

References:

Casino arizona poker

References:

https://forum.dsapinstitute.org/forums/users/warmwindow0/

References:

Online slots no deposit

References:

https://bookmarks4.men/story.php?title=top-live-casinos-echte-spiele-mit-live-dealern

References:

Hard rock casino northfield ohio

References:

http://dokuwiki.stream/index.php?title=Candy96_Reviews_Read_Customer_Service_Reviews_of_candy96_com&action=submit

References:

Canadian casinos

References:

https://bookmarkingworld.review/story.php?title=candy96-online-casino-australia-100-welcome-bonus-and-other-bonuses

References:

Downstream casino joplin mo

References:

http://muhaylovakoliba.1gb.ua/user/leafeast53/

References:

Online mobile casino

References:

https://imoodle.win/wiki/Los_mejores_mtodos_de_pago_de_casino_online_2026

References:

High winds casino

References:

https://bookmarks4.men/story.php?title=offizielle-webseite-von-slotpark-kostenloses-social-casino

over the counter steroids for muscle building

References:

https://md.chaosdorf.de/s/n8eo4hIMkI

safest anabolic steroid

References:

https://imoodle.win/wiki/7_Lebensmittel_die_das_Testosteron_auf_natrliche_Weise_steigern_knnen

can a doctor prescribe anabolic steroids

References:

https://chase-chase.technetbloggers.de/comprar-dianabol-10-mg-comprimidos-en-espana-con-entrega-rapida

did arnold use steroids

References:

https://timeoftheworld.date/wiki/Meilleur_brleur_de_graisse_2025_notre_top_10_expert

References:

Casino barriere

References:

https://www.udrpsearch.com/user/bodytea60

References:

Roulette

References:

https://scientific-programs.science/wiki/Live_Dealer_Casino_Games_at_Candy96_RealTime_Blackjack_Roulette_More

References:

Casino florida

References:

https://pattern-wiki.win/wiki/96_com_1_Trusted_Online_Casino_Sports_and_Crypto_Betting_Site

References:

Vernon casino

References:

https://pediascape.science/wiki/Login

References:

Casinos online bonos

References:

https://yogicentral.science/wiki/Candy_Casino_Review_2026_Slots_Bonuses_Ratings

References:

Winners casino

References:

https://platform.joinus4health.eu/forums/users/sheeppail8/

Hey There. I found your blog using msn. This is an extremely well written article.

I will make sure to bookmark it and come back to read more of your useful info.

Thanks for the post. I’ll definitely comeback.

References:

Mexican jumping beans video

References:

https://ai-db.science/wiki/Claim_Your_Bonus

References:

Venice casino

References:

https://timeoftheworld.date/wiki/Top_Real_Money_Online_Casino_2026

steroid vs hormone

References:

https://yogicentral.science/wiki/5_Best_Testosterone_Boosters_of_2025_Top_Picks_for_Strength

Я не могу не отметить стиль и ясность изложения в этой статье. Автор использовал простой и понятный язык, что помогло мне легко усвоить материал. Огромное спасибо за такой доступный подход!

what is the purpose of anabolic steroids?

References:

https://bookmarkingworld.review/story.php?title=metandienone-wikipedia

can taking steroids affect your period

References:

https://www.blurb.com/user/zoomimosa16

References:

Casino san diego

References:

https://atavi.com/share/xob6y6zusxse

References:

William hill app android

References:

https://onlinevetjobs.com/author/spongerhythm1/

References:

Emploi restomontreal

References:

https://doodleordie.com/profile/raftrhythm2

References:

Rapunzel video

References:

https://maps.google.com.sl/url?q=https://online-spielhallen.de/888-casino-aktionscode-ihr-schlussel-zu-exklusiven-vorteilen/

References:

Stardust casino

References:

https://scientific-programs.science/wiki/Ist_1Go_Casino_seris_Unvoreingenommene_berprfung

References:

Creek casino wetumpka

References:

https://may22.ru/user/augustpisces31/

References:

Video poker strategy

References:

https://halvorsen-wright.thoughtlanes.net/find-answers-to-your-questions-with-winz-io-help-centre

Good info. Lucky me I reach on your website by accident, I bookmarked it.

References:

Casino royal streaming

References:

https://p.mobile9.com/traincolor79/

References:

Casino acura

References:

https://wifidb.science/wiki/Why_PayID_Fits_the_AlwaysOn_Smartphone_Era

References:

Allslots

References:

https://intensedebate.com/people/israelhand73

cash out refinance https://otvetnow.ru quality movers

gnc maximum shred

References:

http://king-wifi.win//index.php?title=blackhuff0857

what does steroids do

References:

https://pad.stuve.de/s/MnmvRgyxD

https://askoff.ru

men’s muscle wrestling

References:

https://md.ctdo.de/s/WTApGayz73

injectable steroids cycles

References:

https://historydb.date/wiki/Risks_and_Safety_of_Clenbuterol_for_Bodybuilding

best muscle enhancer

References:

https://socialbookmark.stream/story.php?title=clenbuterol-wikipedia

low deposit online casino

best online casinos texas

online casinos real money

rich piana before steroids

References:

https://classifieds.ocala-news.com/author/nutwhale2

steroid body

References:

https://firsturl.de/a42nob5

Я очень доволен, что прочитал эту статью. Она не только предоставила мне интересные факты, но и вызвала новые мысли и идеи. Очень вдохновляющая работа, которая оставляет след в моей памяти!

steroid injections bodybuilding

References:

https://rentry.co/d5o7m4km

will steroids make you fat

References:

https://lovebookmark.win/story.php?title=amazon-com-nugenix-t-booster-free-testosterone-booster-supplement-for-men-90-count-health-household

betmgm new customer promo betmgm-play betmgm North Dakota

corticosteroid drugs

References:

http://downarchive.org/user/cablesteven5/

why are anabolic steroids illegal

References:

https://intensedebate.com/people/dewyak0

legal steroids for sale

References:

https://dreevoo.com/profile.php?pid=1061848

best weight gain pills for women

References:

http://hikvisiondb.webcam/index.php?title=lewishong8539

steroid powder for sale

References:

https://urlscan.io/result/019c2fa7-1539-72b6-b4e3-c332cd65a531/

0ahukewjro_2u–_mahv9fjqihw1ccukq_auidcga|anabolic steroids|acybgnqivwvdk_gu8guso6hssvaojmb0yg:***

References:

https://rentry.co/dgmgihzg

betmgm CO https://betmgm-play.com/ betmgm NY

steroids and suicide

References:

https://ai-db.science/wiki/Ozempic_05_mg_kaufen_Online_Rezept_bestellen

steroid companies

References:

https://bookmark4you.win/story.php?title=ozempic-05-mg-rezeptfrei-kaufen

Автор представляет сложные понятия в доступной форме, что помогает лучше понять тему.

legit steroids online

References:

http://humanlove.stream//index.php?title=wolfepettersson9581

Надеюсь, что эти дополнительные комментарии принесут ещё больше позитивных отзывов на информационную статью!

world abs pro stack review

References:

https://bbs.pku.edu.cn/v2/jump-to.php?url=https://amsterdam-online.nl/wp-content/pgs/testosteron_kopen_2.html

Hi there, just changed into aware of your blog thru Google, and found that it is truly informative. I am going to watch out for brussels. I will appreciate if you continue this in future. Many folks will be benefited out of your writing. Cheers!

Автор старается предоставить достоверную информацию, не влияя на оценку читателей. Это сообщение отправлено с сайта https://ru.gototop.ee/

can anabolic steroids cause diabetes

References:

https://trade-britanica.trade/wiki/Buy_Contrave_Online_Weight_Loss_24h_Delivery

oral trenbolone for sale

References:

https://bbs.pku.edu.cn/v2/jump-to.php?url=https://alfa.edu.rs/pages/anavar_available_for_sale_in_usa_uk_and_australia.html

anabolic steroid use side effects

References:

https://freebookmarkstore.win/story.php?title=anavar-kaufen-sichere-oxandrolon-tabletten-online-bestellen

top 10 bulking supplements

References:

https://rentry.co/km5s4nfg

anabolic steroids bodybuilders

References:

https://sciencewiki.science/wiki/Pilules_et_supplments_de_perte_de_poids

is growth hormone a steroid

References:

https://shelton-shannon-4.mdwrite.net/warnung-appetitz-c3-bcgler-test-2022-c2-bb-10-hersteller-im-vergleich

how do anabolic steroids build muscle

References:

https://marvelvsdc.faith/wiki/Anavar_50mg_Hutech_Labs_Online_kaufen_Preis_358_00_in_Deutschland

Мне понравился четкий и структурированный стиль изложения в статье.

Это помогает создать обстановку для объективного обсуждения.

Explore trust audits fair and endlessness entertaining avenues earning. In ignation casino login, enrich and explore. Explore and empower!

It’s an remarkable article designed for all the online visitors; they will get benefit from it I am sure.

Hello there, just became aware of your blog through Google, and found that it is really informative. I’m going to watch out for brussels. I’ll be grateful if you continue this in future. Numerous people will be benefited from your writing. Cheers!

Я оцениваю умение автора использовать разнообразные источники, чтобы подкрепить свои утверждения.

Enjoy a variety of games for every taste. In crowncoins, generous jackpots and a loyalty program await you. Register and win!

Greetings from Ohio! I’m bored to tears at work so I decided to check out your website on my iphone during lunch break. I really like the knowledge you present here and can’t wait to take a look when I get home. I’m surprised at how quick your blog loaded on my phone .. I’m not even using WIFI, just 3G .. Anyhow, fantastic blog!

Я оцениваю использование автором качественных и достоверных источников для подтверждения своих утверждений.

Experience the electrifying world of online gaming where endless fun awaits. Bovada Roulette offers top slots and no-deposit bonuses for all players.

Hi there, You have done a great job. I will certainly digg it and personally suggest to my friends. I am sure they’ll be benefited from this website.

Big Bass Bonanza — where every spin is a fishing trip! Land the scatters, Big Bass Bonanza tips and tricks unlock free spins, and watch the wild collect massive prizes. Hook your fortune now!