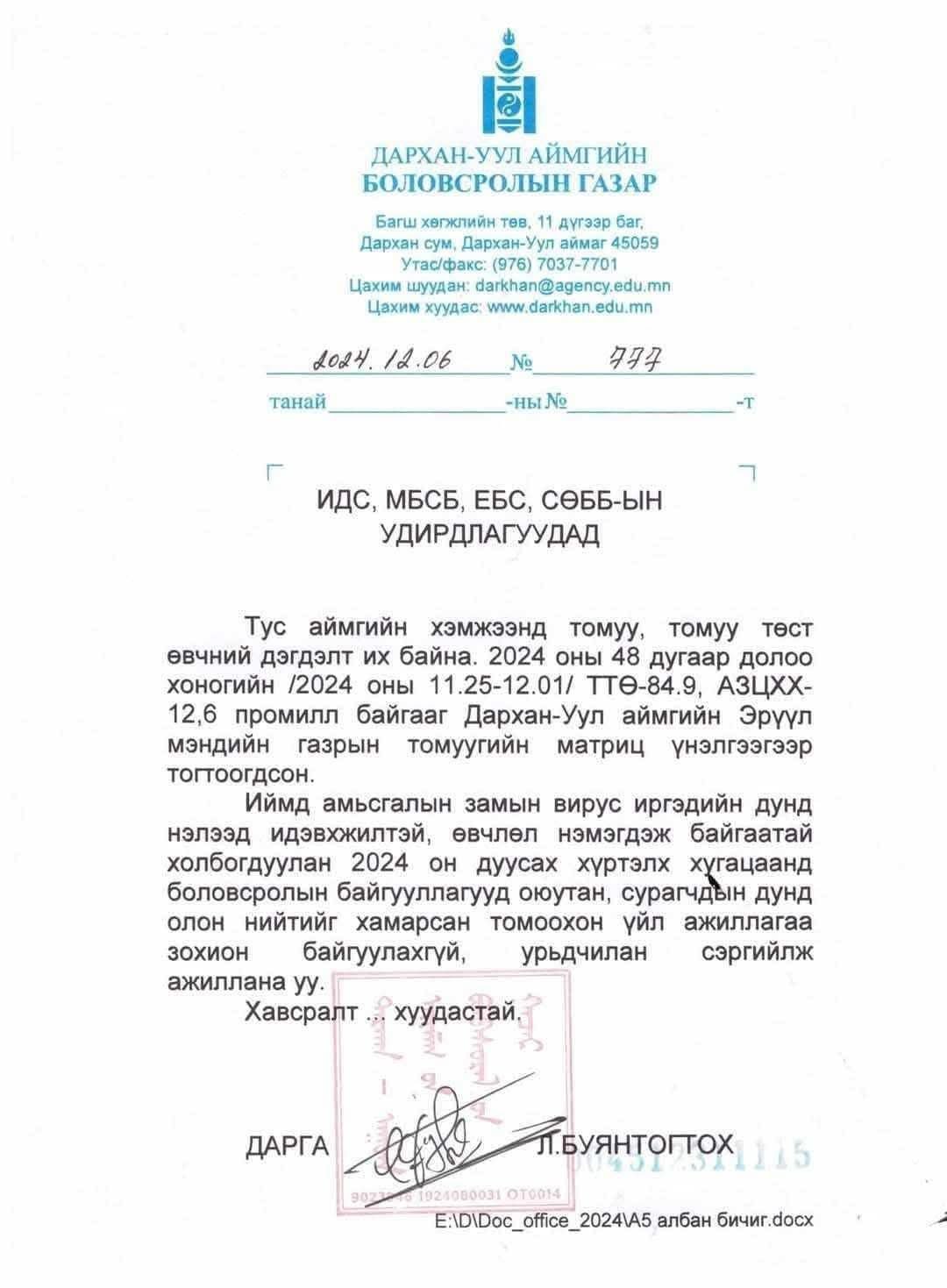

Дархан-Уул аймаг 2024 он дуустал олон нийтийн үйл ажиллагааг хоригложээ

Дархан-Уул аймгийн хэмжээнд томуу, томуу төст өвчний дэгдэлт идэвхижилтэй, өвчлөл нэмэгдэж байгаатай холбогдуулан 2024 он дуусах хүртэлх хугацаанд боловсролын байгууллагууд, оюутан сурагчдын дунд олон нийтийг хамарсан арга хэмжээ зохион байгуулахыг хориглолоо.

Average Rating

606 thoughts on “Дархан-Уул аймаг 2024 он дуустал олон нийтийн үйл ажиллагааг хоригложээ”

Leave a Reply

More Stories

500 мянгаар авсан тавгийн идээ хулхи байжээ

Иргэн: 500 мянгаар авсан тавгийн идээний Архангайн ааруул хулхи. Жил бүр ийм муухай гурилтай ааруул зарж иргэдээ хулхидахаа больцгооё! ...

Улаанбаатарт цас орохгүй, өдөртөө -9 шрадус хүйтэн байна

Өнөөдөр ихэнх нутгаар цаг агаар тогтуун байна. 2026 оны 02 дугаар сарын 09-ний 08 цагаас 20 цаг хүртэлх цаг...

Улаанбаатарт цас орохгүй, өдөртөө -24 хэм хүйтэн

Малчид, иргэд, тээвэрчдийн анхааралд: 20-ныг хүртэл нийт нутгаар хүйтний эрч эрс чангарч, говь, талын нутгаар салхи шуургатай байхыг онцгойлон анхааруулж...

Цалингийн бонус дутуу өгсөн хэмээн захирлыгаа хөнөөсөн аймшигт хэрэг гарчээ

🔴 Японы Токио хотод олон нийтийг цочроосон аймшигт хэрэг гарлаа. Хагас сарын цалинтайгаа тэнцэх мөнгөнөөс болж захирлаа алжээ. Токиод...

Улаанбаатарт цас орохгүй, өдөртөө -12 хэм хүйтэн

Малчид иргэдийн анхааралд: 8-нд нутгийн баруун хагаст, 9-нд нутгийн зүүн хагаст цас орж, цасан шуурга шуурч, Алтайн уулархаг нутаг болон говийн бүс нутгаар салхи шуургатай байхыг анхааруулж байна....

Доналд Трамп Венесуэлийн Ерөнхийлөгч Н.Мадурог хэрхэн баривчилсан тухайгаа Mar-a-Lago дахь ордонгоос мэдээлэл хийжээ

АНУ-ын Ерөнхийлөгч Доналд Трамп Венесуэлийн Ерөнхийлөгч Николас Мадурог хэрхэн баривчилсан тухайгаа Флорида дахь Mar-a-Lago дахь ордонгоос урд шөнө мэдээллийн хэрэгсэлүүдээр...

|

Thinking about a loan against your home to consolidate your financial obligations? Find out more and see what options may be available to you.

Considering releasing equity from your home? Review top lenders and understand your rights and obligations before making a decision.

Home equity release may provide the financial support you’ve been looking for. Learn how to tap into the equity tied up in your home without having to move.

If you’re a homeowner looking to get a loan, a secured loan could be a sensible option. Leverage better rates by using your home as security.

Considering releasing equity from your home? Review top lenders and understand your financial responsibilities before making a decision.

Not sure if a secured loan is right for you? Understand the benefits, such as lower interest rates and increased flexibility.

You may be able to secure larger loans and enjoy better interest rates by using your home’s equity. Review current offers today.

Unlock the value in your property with a secure home equity loan — suitable for funding home improvements, large expenses, or refinancing.

Unlock the equity in your property with a secure home equity loan — suitable for covering home improvements, large expenses, or refinancing.

Thinking about releasing equity from your home? Review top lenders and learn about your financial responsibilities before making a decision.

Uncertain whether a secured loan is right for you? Understand the benefits, such as lower interest rates and larger borrowing amounts.

Uncertain whether a secured loan is right for you? Understand the benefits, such as lower interest rates and larger borrowing amounts.

Release the value in your property with a reliable home equity loan — ideal for funding home improvements, major purchases, or debt consolidation.

Explore how a secured loan can help you access the money you need without selling your home. Review lenders and tailor a plan that fits your needs.

Thinking about a loan against your home to consolidate your debts? Find out more and see what solutions may be available to you.

Equity release solutions may provide the financial freedom you’ve been looking for. Learn how to tap into the equity tied up in your home without having to downsize.

If you’re a homeowner looking to get a loan, a secured loan could be a wise option. Access better rates by using your home as security.

Discover how a secured loan can help you access the money you need without selling your home. Compare lenders and customise a plan that fits your needs.

Discover how a homeowner loan can help you obtain the money you need without selling your home. Compare lenders and customise a plan that fits your needs.

Explore how a secured loan can help you access the money you need without selling your home. Compare lenders and tailor a plan that fits your needs.

If you’re a homeowner looking to borrow money, a secured loan could be a wise option. Access better rates by using your home as security.

If you’re a homeowner looking to get a loan, a secured loan could be a sensible option. Access better rates by using your home as security.

Release the equity in your property with a secure home equity loan — ideal for covering home improvements, large expenses, or refinancing.

You may be able to secure larger loans and enjoy better interest rates by using your home’s equity. Find the best current offers today.

Discover how a homeowner loan can help you obtain the money you need without selling your home. Compare lenders and customise a plan that fits your needs.

Not sure if a secured loan is right for you? Explore the benefits, such as lower interest rates and larger borrowing amounts.

You may be able to borrow more and enjoy lower monthly repayments by using your home’s equity. Review current offers today.

Uncertain whether a secured loan is right for you? Understand the benefits, such as more favourable terms and larger borrowing amounts.

A two-week break follows the cycle adopted up with three weeks of PCT (100mg/day Clomid for

ten days, then followed up with 50mg/day Clomid for an additional

ten days). This stack will allow speedy positive aspects initially with Anadrol, whereas testosterone and Deca

kick in as slower-acting injectables for the remainder of the

cycle. At the very least, Anadrol will all the time be run with a testosterone base in a stack (for

men only). This is often a TRT dose of testosterone to keep up estrogen levels and normal function.

Extended cycles can enhance the chance of liver injury and different antagonistic results.

It is important to monitor levels of cholesterol and liver enzymes throughout the cycle

and regulate dosage or duration as wanted to take care of general health and safety.

Anavar, like Winstrol, is an anabolic Steroids for weight loss steroid that promotes fat loss and muscle definition.

Normally, you’d wish to dose this compound at lower than your dosage of the

primary testosterone compound. If you’re going to run a Deca cycle,

check out my in-depth Deca-Durabolin (Nandrolone) cycle guide.

Dianabol delivers its results by seriously boosting nitrogen retention and

protein synthesis, making muscle growth sooner and extra significant.

It will have a stronger adverse impact on the liver than any other steroid, and this is the main cause why recommendations for its size of use are 4 weeks.

However, some will use it for six weeks and even longer and declare that the liver toxicity impact isn’t as dangerous as

some individuals assume. Some guys are more gyno-sensitive than others, and again, it’s at larger doses that you’ll be

more at risk, but most customers will find it simply mitigated.

Anadrol’s impact on the liver is the biggest concern with

this steroid. Superdrol is the oral version of Masteron, however its results are nothing

like Masteron. Masteron is especially a slicing AAS, whereas Superdrol is likely considered one of the most potent

muscle-building steroids.

Signs that you simply might need low testosterone on account of this suppression include lack

of muscle, fat achieve, lethargy, depression, and low libido.

Different studies at lower doses – 50mg and beneath – have proven much less impact on the liver.

Probably, should you use Anadrol at the lowest dose,

liver unwanted effects could additionally be minimized

in wholesome individuals. Liver support supplements can optionally present some safety regardless of your Anadrol dose.

By the tip of the primary month, you should be at your

peak results, with a highly defined and shredded physique and a big improve in strength.

Anavar (Oxandrolone) is a game-changing steroid that may deliver outstanding

leads to only a matter of weeks. To give you a

better idea of what to expect, we’ve put together a timeline of Anavar results, accompanied

by real before and after photos.

Testosterone complements trenbolone properly, being one other injectable compound and thus not posing any further danger to hepatic health.

Furthermore, primarily based on our lab outcomes, testosterone solely has

subtle effects on cholesterol values, and thus it’s perhaps the least dangerous anabolic steroid to combine with trenbolone.

Anavar grew to become an efficacious cutting steroid,

displaying much less poisonous effects than different

anabolic steroids.

Typically, this will be barely above your upkeep calorie needs.

How much of a rise can vary from man to

man, but it shouldn’t take a thousand calorie

per day surplus, generally far less. Of course, we must also take into account what the

upkeep level is. The sooner and stronger your metabolism is, which is partially affected by your

whole muscle mass, may also affect your maintenance stage. Nevertheless, for prime quality Deca Durabolin results,

regardless of where maintenance is, we are going to solely increase

total consumption slightly. Some body fats achieve will occur, however we

want to keep this as minimal as potential. The primary use for Anavar is slicing, meaning bodybuilders use var to assist them lose weight faster while also sustaining lean muscle mass.

Earlier Than we stroll you thru the numerous transformation in individuals who

have relied closely on steroids to achieve their physique

targets, let us first introduce you to steroids.

Leveraging Deca Durabolin correctly, acknowledging the time it

takes to see adjustments whereas training persistent self-discipline, will be key

to reaching your required fitness goals. Deca Durabolin, despite its reputation in health circles, isn’t without potential

drawbacks. There are a few side effects that customers should pay consideration to,

so they can catch them early on and take applicable motion. We have found that an additional 10 lbs of mass can be gained when adding

testosterone or Deca Durabolin to a Dianabol cycle.

Typical characteristics of skin ailments amenable to remedy with topical corticosteroids

embody inflammation, hyperproliferation, and immunologic etiology.

Each compounds will pressure the joints, but when it comes

to suppression, it’s S-23 that is extra suppressive.

Private preference between steroids and non-steroids is more probably to decide

your selection between the similar Winstrol or S-23.

I am regular reader, how are you everybody? This piece

of writing posted at this site is in fact fastidious.

My blog post … nordvpn coupons inspiresensation (t.co)

350fairfax nordvpn

I do not even know how I ended up here, but I thought this post was good.

I do not know who you are but definitely you’re going to

a famous blogger if you are not already 😉 Cheers!

my blog; nord vpn promo

This post is top-notch.

The depth in this write-up is commendable.

D-Bal’s highly effective formulation mimics

the effects of Methandrostenolone, in any

other case often identified as Dianabol, the granddaddy of steroids.

what Are some of the (bcde.ru) if you could get

the efficiency enhancing, muscle constructing effects of a steroid without taking

steroids? For this cause, it is necessary to prioritize protein-rich foods

in your food regimen whereas using steroids.

Eat loads of fish, lean meats, low-fat dairy merchandise, eggs, and cottage

cheese. For the whole 12 weeks of the cycle, you

may have to take the testosterone and winstrol combo together.

When it involves maximizing the positive aspects out of your Check

Cyp and Winstrol cycle, a well-planned vitamin and complement strategy is

crucial. The proper combination of complementary supplements can assist your body’s wants during this intense cycle, helping you achieve superior results.

Here, we’ll dive into the best dietary supplements

and diet tricks to optimize your performance and gains.

Keep In Mind, these pointers are just a place to begin,

and it’s important to listen to your physique and make adjustments accordingly.

Winstrol stacks with steroids are determined primarily by the top goals of the

users, but Take A Look At and Winstrol appear the best

and popular. In an try and normalize blood pressure, users are recommended to take four grams of fish oil per day, combined

with healthy consuming and regular cardiovascular train. Although endurance activities is most likely not

what some bodybuilders want to do when bulking, they can offer

cardiac protection. Anavar will worsen testosterone suppression post-cycle, requiring a more advanced

PCT in comparability with a testosterone-only cycle.

Nonetheless, our testing shows that Anavar’s antagonistic results on endogenous testosterone are gentle compared to

different anabolic steroids. Anavar is generally considered as a chopping steroid due

to its powerful fat-burning results. This is as a end result

of of Anavar’s capacity to increase the ratio of triiodothyronine (T3) to thyroxine (T4) in the physique (5), stimulating metabolism

and fat loss.

However, due to some likely water retention from the addition of testosterone, it’s extra suitable for bulking.

Winstrol helps you keep muscles while cutting, and has an insane benefit to overall athletic efficiency.

If you’re a woman in search of a steroid and want a lower chance of virilization (compared to other steroids), then Winstrol might be an possibility.

Winstrol is extra favorable for cutting muscle

tissue rather than bulking. While it may work, it isn’t as effective as other steroids.

Although it is illegal in sports, Winstrol is a mostly protected, delicate anabolic steroid used by men and women alike.

Over time, it has proven to boost performance and physique, enhance endurance and promote power without the extra mass.

This is partly as a end result of Dianabol being a potent oral steroid, which

is well known for worsening cholesterol levels as it stimulates

hepatic lipase within the liver. Winstrol is a chopping

steroid that produces vital outcomes, particularly when stacked with

other steroids. Nonetheless, we know Winstrol’s side effects are just as potent

because the results it yields. Subsequently, Winstrol is usually only cycled in reasonable doses by intermediate steroid users who tolerate it well.

Customers can take an AI (aromatase inhibitor), which we’ve found to obtain success in reducing progesterone-related unwanted side effects.

However, AIs can further spike blood strain, as estrogen performs

a job in elevating HDL (good ldl cholesterol levels).

Anadrol could be very estrogenic, so biking this steroid in conjunction with

a high-sodium diet is a recipe for water retention and easy muscle tissue.

Final but not least, a Take A Look At Cyp and Winstrol cycle additionally promotes vascularity.

These compounds work together to cut back subcutaneous

water retention, giving your muscular tissues a more durable, more defined look.

The Test and Winstrol Cycle is essentially the most extensively used and highly beneficial

to be mixed with Stanozolol.

It is generally best to wait for a week after your testosterone and winstrol cycle ends.

So this will be on the 14th week after you started taking

the steroid combo. Take notice that each post cycle therapy

is dependent upon what kind of steroids you take.

There is often a false impression that steroids are to be taken regularly.

Everlasting consumption of all synthetic steroids is

highly harmful to the physique. This is why there are so much of steroids that

would by no means get an approval from the FDA.

Given the popularity of Anavar, a rival chopping steroid, this is indicative of Winstrol’s anabolism.

As A End Result Of there will be a light suppression of testosterone manufacturing, a PCT

protocol is sensible. The primary aim might be to revive testosterone production whereas retaining

all the advantages you gained from the cycle.

Thanks for posting. It’s a solid effort.

More blogs like this would make the blogosphere richer.

I’ll gladly bookmark this page.

I learned a lot from this.

Thanks for putting this up. It’s well done.

I really enjoyed the style this was laid out.

I found new insight from this.

Thanks for creating this. It’s top quality.

I discovered useful points from this.

More blogs like this would make the web a better place.

This article is excellent.

I learned a lot from this.

Such a informative insight.

Such a helpful bit of content.

This is the kind of content I enjoy reading.

I genuinely appreciated the manner this was laid out.

I truly admired the manner this was laid out.

Such a beneficial resource.

I genuinely enjoyed the manner this was written.

Any drug administered in excessive doses that

is in a position to enhance coronary heart rate can have long-term unwanted effects.

Possession and distribution of anabolic steroids with no prescription can have serious authorized repercussions.

When you are taking steroids for any time period the goal is to inflate your current hormone

levels and encourage muscle progress, performance and endurance.

Trenbolone’s high androgenicity is partly liable for

its spectacular results; nonetheless, we now have seen this cause

acne vulgaris (and cystic acne) in some customers.

Trenbolone will have a drastic impact on blood lipids, inflicting a rise in coronary heart hypertrophy (size), leading to

a higher probability of atherosclerosis. Nevertheless,

we nonetheless see AST and ALT liver enzymes rise because of trenbolone passing through the liver upon exit.

Trenbolone’s androgenic rating of 500 vs. testosterone’s 100 demonstrates its raw power in this regard.

Androgen receptors are current in fat cells, and thus, when stimulated, lipolysis increases (4).

Bodybuilders typically opt for the injectable kind, with it being considerably cheaper and stronger than oral

testosterone. Dianabol can be liver toxic, being a C-17 alpha-alkylated

steroid, thus having to pass via the liver in order to

become active.

This is the gradual lower in corticosteroid dosing to permit the

body time to get its cortisol ranges again to regular.

The enhance in hormonal activity suppresses the immune system, which is responsible for activating inflammation in the physique.

By suppressing immune system exercise, corticosteroids can cut back inflammation. Corticosteroids have several different results on the body, meaning they will deal with various

medical conditions. They can reduce irritation, suppress overactive immune system

responses, and assist with hormonal imbalances.

Clenbuterol is a potent drug and bodybuilders and athletes who

take it usually achieve this in much greater doses than beneficial.

Don’t have immunisations with live vaccines while you’re having treatment and for as

a lot as 12 months afterwards. Ask your doctor or pharmacist how

lengthy you must keep away from stay vaccinations.

If you’re having checks or therapy for the rest, at all

times point out that you are taking steroids. Discuss to

your physician or nurse about efficient contraception earlier than starting your

most cancers remedy. Let them know immediately if you

or your associate falls pregnant while having treatment.

You have common blood tests throughout your therapy so your

doctor can examine this.

Triamcinolone injections can offer relief

for a number of weeks to months, making them suitable for persistent conditions.

For example, a person with extreme knee arthritis would possibly receive

a triamcinolone injection to reduce ache and enhance mobility for an extended period.

These treatments are administered by healthcare professionals and serve to scale back irritation and supply pain relief.

John Smith is a behavioral well being specialist with over 15 years of experience in the subject of addiction treatment.

He is an expert in treating alcoholism and drug habit, in addition to

a skilled psychological health and substance abuse counselor.

“Gym juice” is a slang time period usually used within the health and bodybuilding group to discuss with steroids.

This is a slang time period for Winstrol-V, which is an anabolic

steroid commonly used by athletes and bodybuilders

to reinforce efficiency and build muscle. It is derived from the model name “Winstrol” and the

letter “V” is added to point the veterinary form of the drug.

T4, also recognized as Levothyroxine Sodium, is a synthetic form of the thyroid hormone thyroxine.

It is used medically to treat hypothyroidism and sure kinds

of goiters.

This time period refers to individuals who use steroids to enhance their weightlifting or power training performance.

Weight trainers often use steroids to extend muscle mass,

improve restoration, and enhance general strength. In 1953, a testosterone-derived steroid often known as norethandrolone (17α-ethyl-19-nortestosterone) was synthesized at G.

For instance, someone with extreme rheumatoid arthritis

of their knees would possibly find that over-the-counter anti-inflammatory medication and bodily remedy aren’t

enough.

In reality, Anavar is a very common steroid which is getting used

each by women and men as nicely as by steroid customers newbies and

steroid users veteransalike.What is Anavar? Anavar won’t affect

a woman’s ability to get pregnant although Anavar has been proven to intervene with

the body’s organic indicators which have an result on being pregnant.What is the facet effects?

In order to find out what Anavar tablets you should take as the correct dose

to find a way to maximise its results we recommend that you just learn our Anavar Dosage Information, shopping for anabolic

steroids philippines. The first degree is identified as non-hormonal and helps

us regulate our hormones and retains our bodies in a healthy working shape.

Anabolic and androgenic steroids can be found as prescription medicines to be used in cases during which the body

does not make enough hormone and supplementation may be required.

Some hormone supplements on this pathway include progress hormone and testosterone itself.

Welcome to the NicknameDB entry on anabolic steroid nicknames!

Below you will discover name concepts for anabolic steroid

ingredients – http://genome-tech.ucsd.edu – steroid with different

categories relying in your wants. If you hear somebody talking about

“Juice,” they’re not discussing a healthy drink however a substance that

can damage your physique. Finally, terms like “Weight Trainers” and “Gear”

make steroids seem like another piece of gym gear.

Figuring Out these slang terms can help you navigate conversations and keep knowledgeable

about what’s being mentioned. Prednisone is a prescription medication that can assist treat a wide

range of situations and illnesses. Right Here are solutions to different frequent questions individuals ask about this drug.

Steroid injections could cause fluid retention, resulting in liftd blood stress.

Your doctor might suggest monitoring your blood stress extra regularly after the injection. Steroid injections offer a

potent, instant solution for managing pain and

inflammation, permitting individuals to regain their mobility and

enhance their quality of life. Steroid injections are highly effective at reducing irritation.

More posts like this would make the blogosphere better.

I’ll gladly be back for more.

I truly appreciated the way this was presented.

More blogs like this would make the online space better.

This is the kind of post I truly appreciate.

Such a practical insight.

I found new insight from this.

I’ll certainly bookmark this page.

I truly valued the manner this was explained.

The depth in this content is commendable.

Planning and recording your workouts and private health objectives with an app could be

a quick, straightforward method to verify you’re staying on observe.

Nevertheless, it doesn’t outcome in the

muscle-building claims this drug’s advertising copy might lead you to consider.

Look out for any extra ingredients in supplements which will

have unwanted effects or cause allergic reactions. Testosterone is a

hormone that plays an important function in men and

women, though it is present in a lot greater levels in males.

Veterinarians additionally routinely administer anabolic steroids to canine, cats, horses, cows and different animals to have the ability

to promote increased strength and vigor, elevated weight achieve and a

wholesome, shiny coat. Keep in mind that although steroids can enhance your performance

and muscle progress, the risks could outweigh the benefits.

It’s essential to learn about the potential consequences of utilizing steroids

and consider alternative ways to reach your

goals. The commonest types of authorized steroids are completely

different variants of testosterone, corresponding to testosterone cypionate,

testosterone enanthate and testosterone propionate.

These stand on equal footing with other managed substances that

are also legally obtainable corresponding to HGH and HCH.

Enhancement of athletic efficiency is considered a

need and never a medical condition under the legislation, which suggests a person will not be allowed to make

use of steroids for efficiency enhancement. The use of the substance for this objective is taken into account unlawful, despite the very fact that it stays widespread.

In bodybuilding, desirous to get vital progress of strength and muscle

in a extremely short time frame will make the person resort to anabolic

steroids. The ensuing medical dangers and illegality make it a very unsafe transfer.

This information talks about the safest of steroids to take—proper alternatives to

anabolic steroids with the same outcome however minus the unwanted effects.

Whether Or Not you’re starting your very first steroid cycle or you just wish to

acquire strength naturally, this text gives you the facts on the most effective authorized

steroids to make the most of when chopping, bulking, and constructing

muscle. Whether Or Not you are considering TRT for medical reasons or are tempted by steroids for performance enhancement, the long-term results should weigh heavily in your

choice. Seek The Advice Of a healthcare provider to discuss your well being, goals,

and any potential risks.

Post Cycle Remedy is the method of stopping a steroid cycle, shedding saved

muscle mass, and re-building lean muscle.

Throughout submit cycle remedy, the bodybuilder stops his steroid cycle and proceeds

to get well from the results of the medicine.

The drugs which would possibly be usually used in PCT embody

clomiphene citrate, HCG, and Tamoxifen. These merchandise are sometimes paired with a food regimen that is

high in protein, low in carbs and fats. Testo-Max is a wonderful authorized steroid for males who need to boost their testosterone levels.

This supplement accommodates only natural ingredients and is safe to use.

Anabolic steroids are unlawful throughout Australia except they are prescribed by a

doctor for a medical purpose.

Customers typically report with the power to carry heavier weights, run sooner, or practice more durable throughout workouts.

Testosterone is assumed to play a task in cognitive perform, including

memory and focus. TRT might help enhance brain perform, particularly in older individuals or these with low

testosterone. They are fairly frequent in the UK;

greater than 1 million people are taking them, all from teenagers to aged individuals.

It’s like turning up the volume on those feelings,

and it might possibly make it tougher to control emotions.

They can raise the chances of your heart having bother or even having a heart assault, which is a serious well being drawback.

Despite these consequences, some athletes proceed to make use of PEDs

to gain a competitive edge, highlighting the continued problem of addressing doping in sports activities.

Creatine appears to help muscles make extra of an vitality

source referred to as adenosine triphosphate (ATP).

It’s used for activity that includes fast bursts

of motion, similar to weightlifting or sprinting.

But there’s no proof that creatine helps you do higher at sports activities that make you breathe at a higher

price and lift your coronary heart fee, referred to as cardio sports activities.

Diuretics are drugs that change the body’s balance

of fluids and salts. They may cause the body to lose water,

which might decrease an athlete’s weight.

At All Times rely on medical recommendation to guide

your selections, and avoid taking pointless risks along with your body.

Testosterone Substitute Remedy (TRT) and anabolic steroids are two phrases that folks typically hear in discussions about testosterone,

muscle progress, or treating low energy ranges.

Whereas they might sound similar, they’re very totally different in how they are used,

why they’re used, and the risks they carry.

Understanding these differences is necessary,

especially if you are someone who could also be contemplating one of

these options to deal with a medical situation or to reinforce

your physical efficiency. This article goals to make clear what TRT and steroids are, how they work, and which

one might fit your specific wants.

D-Bal has been hailed as one of many strongest legal steroid pills

for muscle growth; http://newslabx.csie.ntu.edu.Tw:3000/annieperry1396/can-you-drink-alcohol-with-steroids2001/wiki/Dianabol-Cycle:-FAQs-And-Harm-Reduction-Protocols,

steroid alternate options for muscle progress in 2025.

Its triple-action formulation guarantees maximum muscle growth, power, and performance.

The complement boosts your physique’s anabolic environment, allowing you to realize serious muscle gain.

In Thailand, anabolic steroids are considered a controlled substance.

Possession with no prescription is unlawful, and carrying them can lead to fines and imprisonment.

More blogs like this would make the internet richer.

Such a valuable read.

The clarity in this write-up is commendable.

I’ll certainly recommend this.

Follow a daily exercise routine and minimize out eating junk food to get most

benefits from Winsol capsules. Whether you are hitting the health club or just staying

active, Testo Prime helps muscle progress by enhancing protein synthesis—helping you get more out of every exercise.

It blends measurement, strength, fat-burning, recovery, and hormonal support into one streamlined, synergistic cycle, providing a complete solution on your health journey.

CrazyBulk backs its merchandise with a 60-day money-back

assure, designed to offer you a risk-free window

to strive the supplements and see if they’re a good match for your coaching and way of

life. It’s hard to build or retain muscle if you’re at all times low on vitality or hitting fatigue halfway via your exercises.

Most individuals need to construct a formidable physique with out resorting to black market steroids or injections.

The desire for a protected, legal, and accessible option that

still works is not only prevalent, but also an indication of a accountable and health-conscious approach to fitness.

Authorized steroids for men are protected and effective pure supplements that provide comparable advantages to anabolic steroids with out the negative unwanted facet effects.

In conclusion, Clenbutrol is a authorized and secure various to Clenbuterol, which is legendary

for its effectiveness in cutting cycles. Its thermogenic properties makes it

a potent natural fats burner by melting down excess weight while preserving lean muscle mass.

To actually unlock the full benefits of these powerful muscle-building formulas, you want the proper strategy.

Here’s how to ensure you get sooner, better, and longer-lasting results from

your legal steroid cycles. Trustworthy natural steroid alternate options will disclose all components

and dosages on their labels. Keep Away From merchandise that disguise behind “proprietary blends” because you deserve to know exactly what you

are putting into your physique.A clear, transparent label is

a powerful signal of quality and security.

The supplement additionally offers advantages similar to improved metabolism, oxygen transportation,

and quicker restoration. Many customers noticed a noticeable distinction when utilizing

this highly effective supplement. Additionally, these supplements can help improve energy levels, cut back

restoration time, and enhance psychological focus, making them

a popular selection amongst athletes and bodybuilders.

Not Like conventional steroids, this complement does not put your

well being at risk.

“The websites are readily accessible to users on this country but are primarily based in international locations where steroids are unregulated. Any steroids we have ever seized have been manufactured in foreign nations.”

Trendrolone additionally has the particular operate

of promoting nitrogen retention while additionally increasing the circulate of oxygen to the muscles.

Trenorol comes in capsule form, making it straightforward to include into your every day routine.

This is good in comparability to administering conventional anabolic steroid injections, which need to be done under the supervision of a medical skilled.

Clenbutrol’s thermogenic qualities help enhance the physique’s inner

temperature, resulting in a better caloric burn fee and accelerated weight loss.

This implies that your body will use more fat as

gasoline on your wants during train. It is the perfect

supplement to assist you take pleasure in lengthy and enjoyable cardio periods or even high intensity workouts for strength objectives.

Overall, Winsol serves as an excellent complement for efficiency improvement, weight reduction and energy acquire, and is normally taken pre-workout.

Dianabol is widely recognized as one of the most powerful anabolic steroids in the marketplace

today, offering great energy and vital gains for physique builders

all over the world.

Dietary Supplements with optimistic critiques and high buyer satisfaction charges got choice.

We scrutinized the dosage of every ingredient to ensure it’s each protected

and efficient. We only recommend supplements that contain components in doses that are confirmed to be efficient.

WinsdrolV is the safe and authorized substitute to the synthetic anabolic known as

Winstrol. Simply like different merchandise on this list, Winsdrol V is made from only natural elements.

Loopy Bulk’s HGH-X2 is an effective, authorized and safe different to HGH progress hormone, which is used to take care of high testosterone levels within the body into

adulthood.

Whether you are simply beginning out otherwise you’re an experienced athlete, there’s a personalized CrazyBulk product

for every section of your fitness journey. Here

Is a fast information on how to align your objectives with the most suitable product(s).

CrazyBulk makes use of elements like Ashwagandha, D-Aspartic Acid, and Fenugreek — all

recognized for his or her natural anabolic-support potential.

It is the legal alternative to the anabolic pathway Definition steroid Deca-Durabolin, which is understood for its muscle-building properties however comes with many adverse side-effects.

Today’s fitness-minded client is smarter, extra cautious, and extra research-driven.

Folks need real efficiency support with out the medical dangers

or authorized penalties tied to anabolic steroids.

Make sure you have read the directions and adopted them well,

or else, you may experience some digestive distress.

Take 4 capsules of Testomax before breakfast, three capsules of Trenorol, and DecaDuro 45 minutes earlier than exercise.

It is finest to take all four dietary supplements together within the manner prescribed by the website.

Readers are strongly encouraged to visit the official web site of the

product manufacturer for probably the most current and accurate info.

Winstrol additionally doesn’t aromatize (9), causing the

muscle tissue to seem dry Pros And Cons Of Heroin grainy.

I will let you know how to use every of those compounds to the

best impact and more importantly, safely.

I may also tell you where you can acquire legal anabolic steroids for personal

use. Oral anabolic steroids like Dianabol and Anadrol could be particularly toxic to the liver.

Prolonged use may result in liver dysfunction,

liver cancer, and other liver-related points.

Choosing a authorized steroid comes down to which model delivers the most benefits you’re looking for, whether or

not it’s a testosterone booster or a post-cycle method.

This steroid supplement is incredibly versatile and can be stacked with another legal steroids from Large Diet, although it

actually works especially well when paired with arachidonic acid.

Some athletes may seem to get an edge from performance-enhancing

medication. Athletes take human growth hormone, additionally called somatotropin, to construct more muscle and do higher at their

sports.

Testosterone is the cornerstone of any bulking cycle and one of the versatile steroids available.

Whether you’re utilizing Testosterone Enanthate, Cypionate, or Sustanon, this hormone delivers constant and reliable muscle progress.

From building huge positive aspects to stripping

fats and getting ripped, we’ve rounded up the most effective steroids which are legal

to buy and secure to make use of within the USA for each part of your weight training.

This makes Nandrolone one of the properly tolerated anabolic

steroids for adult males. Nandrolone possess very little estrogenic exercise with an aromatase rate of only 20% that of Testosterone.

It is classified as an active progestin and this will play into

potential unwanted effects, however they’re controllable typically.

Cosmetically, anabolic steroids are wanted for

growing muscle mass, physique weight, and muscle definition,

serving to individuals look more muscular and toned.

For the male performance enhancing athlete, a 20-30mg per day dosing will present athletic enhancement, however most

will find 40-50mg per day to be much more efficient.

80mg per day isn’t unusual, however this will improve the chance of side

effects.

Legal steroids are available for buy over-the-counter and will include natural components like ecdysterone,

creatine, betaine, and saponins. Large Nutrition Sapogenix is one

of the best authorized steroid overall with potent plant saponins and a

sophisticated absorption system. Epicatechin is a

pure compound present in green tea and dark chocolate, so it’s

one of many safest steroid alternate options to incorporate into your daily routine.

There are plenty of choices on the market if you’re

on the lookout for trusted steroid alternatives from natural supplement brands.

Deca-Durabolin Cycle for Endurance and Recovery A typical Deca-Durabolin cycle lasts

about eight to 12 weeks. It is often used alongside different steroids like Testosterone to get the most effective outcomes.

Testosterone is essential for constructing severe muscle and is the primary

hormone included into any muscle-gaining regimen. It additionally has a vital operate in sustaining and

boosting libido, mood, and sexual drive, without which natural athletic

efficiency and total well-being cannot be guaranteed.

Deca Durabolin, also referred to as Nandrolone Decanoate, is a prime

injectable steroid. It Is really good for constructing sturdy muscle tissue and

easing joint ache. Customers might get puffy, develop gynecomastia,

have zits, or gain weight quick.

Very low doses of Nandrolone will provide the reduction and restoration they want, and a barely higher dose will present this along with elevated ranges

of muscular endurance. Equally important, particularly because it pertains to reduction, this isn’t false relief or a

masking effect – we’re not talking about painkillers

however true relief. Stick to beneficial doses, monitor your well being with blood tests,

and use supplements like milk thistle for liver help.

Accountable use with medical oversight is vital to safer,

effective bulking. Steroids are utilized in cycles (6–12

weeks), followed by Post-Cycle Therapy (PCT) to revive natural testosterone

ranges and reduce unwanted aspect effects. Anavar or Oxandrolone is

specifically a dihydrotestosterone (DHT) hormone that has been structurally altered.

The Stanozolol hormone was first developed by Winthrop Laboratories beneath the trade name Winstrol.

The Stanozolol hormone has since been discovered underneath quite a few model names across the globe, but the Winstrol name has remained

the preferred and properly recognized. These embody oily pores and

skin, hypertension, and altering cholesterol levels. It can also lower testosterone, which affects testicular dimension and sperm

depend and mobility. In 2018, there have been 87 doping

circumstances with Boldenone, displaying it might be misused with serious dangers.

Ladies would possibly discover facial hair progress

or hair loss on their heads. They scale back muscle damage and inflammation after train, which

retains energy and endurance up. Steroids aren’t just about size—they’re additionally about getting

stronger and performing higher. Customers can push heavier weights and generate extra pressure in the gym.

We will make to give you the absolute best quality, a

hundred % authentic designer luxurious brands.

We have made positive that our goods professionally packaged and delivered

on time.

By improving nutrient absorption and selling sooner recovery instances, Deca permits athletes to train tougher and more frequently

with out overtraining or risking long-term harm. For muscle recovery,

Deca-Durabolin (Nandrolone Decanoate) is a standout anabolic steroid.

Though primarily generally recognized as a bulking steroid, Deca-Durabolin may also

be used throughout slicing cycles—especially for those coping with

joint pain. Whether Or Not you are aiming to bulk up, reduce down, or boost your

athletic performance, having a clear plan ensures you maximize features whereas staying in control of your progress.

It Is frequent for athletes who train for lengthy quantities of time to use a lab-made kind of erythropoietin referred to as epoetin. Study how these drugs work and the way they’ll have effects on your

well being. As A Outcome Of of this, it is necessary to be conscious of what steroids are

and how they’ll affect your body – both physically, sexually,

psychologically, and legally.

When you take Anadrole, anticipate your physique to begin making extra red blood cells to help speed up your restoration.

For instance oral steroids can be tougher on the liver than injectable.

Knowing the pros and cons of various administration strategies will help you choose

the most secure in your wants. It’s a potent substance that is utilized in most pre-training mixtures.

Along with caffeine, it can give you endurance, motivation, and, most importantly

– the best aggressive mindset to make your workout effective.

Might seem like a simple question, but the reality is far extra complex.

Although legal steroids may probably cause some points, they’re

much safer and significantly less prone to have unwanted aspect effects than anabolic steroids (10).

Ladies should take extra caution when utilizing authorized mail order steroids (https://slimmerfietsen.nl),

as they might potentially enhance ranges of testosterone.

Many legal steroids aren’t properly studied, so their results on hormone ranges

in ladies are still not well-known.

Additionally, some of the well-known authorized steroid alternatives is D-Bal

Max, a complement designed to copy the muscle-building effects of anabolic steroids without dangerous unwanted side effects.

It combines scientifically backed ingredients to promote lean muscle progress,

enhance endurance, and accelerate post-workout restoration. Prime Male

is a well-liked legal steroid that has garnered a powerful following as

a end result of its effectiveness in serving to

people construct muscle mass, shred fat, and enhance testosterone ranges.

Made from a mix of natural ingredients, Prime Male is particularly designed for men who need to

enhance their exercise efficiency, increase lean muscle mass, and improve total power levels.

These scientifically backed choices not only contribute

to higher general well being but in addition guarantee efficient

and secure progress towards fitness targets. These dietary supplements

work by selling the body’s pure synthesis of human development hormone, resulting

in enhanced efficiency, decreased fat, and elevated muscle development.

This saves you the ache of needles and likewise lowers the chance for a broad range of disease and issues.

A nice example is that since athletes prepare so exhausting, they usually need prolonged recovery to protect their our bodies from damage.

Utilizing steroids may help athletes workout intensely and get well more rapidly.

If you’re looking for an efficient approach to construct muscle, D-Aspartic Acid is worth contemplating.

In Contrast To steroids, TestoPrime helps your

physique produce the optimum amount of testosterone for your age.

Total, I am more than happy with my outcomes from utilizing Testo-Max.

It helped me reach my fitness goals quicker, and I

extremely advocate it to anyone trying to get serious about their gains.

During the primary week, I observed a gradual enhance in my power ranges and an enchancment in my

sleeping pattern.

With quite a few choices available in the market, selecting

the right authorized steroid may seem overwhelming. When it involves authorized steroids, D-Bal Max is probably certainly one

of the most dependable merchandise. Many bodybuilders and athletes have benefited from its advantages quite a few times.

There are hundreds of bodybuilders who use D-Bal Max

V2 to bulk up. Artificial Dianabol mimics the consequences of anabolic steroids with

out damaging their very important organs. As

a results of regular consumption, you experiencefast-paced muscle

features. Created to offer a safer different to conventional

anabolic steroids, authorized steroids are formulated using potent pure components like amino

acids, vitamins, minerals, and plant extracts.

If you’re in search of a legal and secure various to anabolic

steroids – especially for fitness and athletic purposes – then I suggest the CrazyBulk range of dietary supplements.

Hunter Check is a legal complement that focuses

on boosting testosterone ranges and improving total performance.

It contains elements like ashwagandha and indole-3-carbinol, that are recognized for his or her ability to extend testosterone production and help hormonal steadiness.

D-Bal from CrazyBulk is a authorized supplement that is called the closest factor to steroids for bodybuilding.

Muscle progress refers back to the process by which muscle tissue grows and turns into stronger via protein synthesis.

This can be achieved via various methods, such as train, food regimen, and supplementation. It can be value noting that injecting at the wrong location may

end up in paralysis or death. Thus, though

it could be argued that injectable steroids are safer in regard to having decreased hepatotoxicity,

administering them is doubtlessly deadly to the inexperienced.

Furthermore, needle contamination is a further danger; thus, users

should be wary of hygiene and the sharing of needles.

However they focus on a societal conception that ties value to physical look – a notion that

know-how has made inescapable, she stated. They carry serious risk/side results that, if not correctly monitored,

may be very dangerous, such as blood clots and stroke. Prescription merchandise commonly prescribed to females

with a historical past of hormone-positive breast cancer.

A peptide hormone produced by the liver in response

to the expansion hormone that’s necessary for progress growth.

Nevertheless, many bodybuilders have reported constructive outcomes with Trenorol without

experiencing any adverse unwanted effects. Signs are similar to drug dependancy, corresponding to loss

of appetite, tiredness, restlessness, insomnia, mood swings, and

melancholy. Steroids are so addictive that individuals and

athletes overlook the well being risks, making it onerous

to stop taking them. Furthermore, brick and mortar stores may implement

different pricing strategies primarily based on their enterprise models and overhead prices.

What results is bronchial constriction, making it

tougher for the user to draw large amounts of oxygen into the lungs, particularly during aerobic coaching.

Some people do not expertise this explicit Trenbolone aspect impact in any respect, whereas others do not expertise it when Trenbolone doses are administered below a certain dose.

This specific facet effect, as mentioned, is just temporary and should subside not

very lengthy following termination of a Trenbolone cycle.

Subsequently, bronchial asthma patients should train acceptable responsible choices as

as to whether or to not use Trenbolone. This is partly because of the method it

reacts to the androgen receptors within the muscular tissues.

The enhancements to protein synthesis it provides can lead to

phenomenal features throughout bulking cycles.

The legal status of Trenbolone can vary from country to country,

and even inside regions of a country. Researching and familiarizing yourself with the present legal standing of Trenbolone

will assist you to make knowledgeable choices and ensure compliance with the law.

Additionally, staying updated on any recent changes or proposed legislation associated to Trenbolone may help you navigate this side extra successfully.

Tren has a decreased capacity to create male traits in comparability with testosterone as a result of its androgenic impact remains limited.

Our web site isn’t intended to be an various to skilled medical advice,

prognosis, or therapy. Glomerular toxicity illness interferes with the kidney’s capacity

to clear waste merchandise.

Research turns into difficult as a end result of the substances used for microdosing remain illegal.

The method of Microdosing Tren entails the consumption of small portions under the beneficial therapeutic threshold

of Trenbolone. A small dose administration of Trenbolone serves to increase athletic talents together

with muscular improvement or addresses testosterone inadequacies.

The practice comes with potential hazards that embrace hormone irregularities and negative coronary

heart problems. When choosing one of the best Trenbolone various for you, contemplate

your personal objectives and preferences, as properly as components corresponding to worth,

effectiveness, and potential unwanted effects.

It also enhances the body’s metabolism, making it

an effective agent for fats loss and achieving a

leaner physique. Moreover, Trenbolone has been reported to boost vascularity, promote greater purple blood cell manufacturing, and

improve overall athletic efficiency. Trenbolone’s popularity stems from its exceptional

anabolic results and talent to boost muscle growth and fats loss concurrently.

It is extremely regarded for its potency and effectiveness, usually considered one of

the strongest steroids out there. Trenbolone’s unique molecular

construction makes it resistant to aromatization, eliminating the chance of estrogen-related unwanted aspect effects

similar to water retention and gynecomastia.

Additionally, it enhances protein synthesis and nitrogen retention, leading to increased muscle tissue formation and

enhanced recovery. Due to its spectacular benefits, Trenbolone has

turn into a sought-after compound among severe athletes and bodybuilders trying to push their physical limits and obtain distinctive results.

As a result, the proper precaution with a robust compound

like Trenbolone is to run cycles as quick as attainable. Tren isn’t solely used for enhancing muscular bulk, but in addition is of great importance as a cutting steroid.

In Addition To this, it additionally helps in preserving

lean muscle tissue and enhance protein synthesis. Tren optimizes body’s metabolism

to favour fats loss course of and help improve general muscle

definition. From an novice fitness center goer to knowledgeable bodybuilder, many have turned to trenbolone acetate to speed up their progress.

The substance can be vulnerable to misuse, making it crucial for those considering

it how to get real steroids completely perceive the implications of incorporating trenbolone into

their workout regimen.

Frequent unwanted side effects embrace increased aggression, insomnia, night time sweats,

acne, hair loss, and cardiovascular points.

The compound’s effects on purple blood cell production are one

other essential side of its mechanism. Trenbolone stimulates erythropoiesis,

the method of purple blood cell formation. Increased red blood cell depend can lead

to improved oxygen supply to muscular tissues, probably enhancing endurance and decreasing

fatigue throughout intense exercises. This impact also contributes to the elevated vascularity often observed in Trenbolone customers.

Trenbolone Acetate can exhibit androgenic effects, corresponding

to zits, oily pores and skin, and potential hair loss in individuals genetically predisposed to male pattern baldness.

Proper skincare and hygiene practices, together with regular washing of the affected areas,

can help mitigate acne and oily pores and skin.

Dianabol (Dbol), also known as Methandienone or Methandrostenolone is

amongst the earliest synthesized anabolic steroids and one of

the most in style performance-enhancing substances. Developed in the Nineteen Sixties by Dr.

John Bosley Ziegler, an American physician and chemist,

buy dbol dramatically modified athletics and bodybuilding.

Regardless Of being classified as a managed substance in plenty of countries

and being banned by most sports activities organizations, it remains

extensively utilized by many athletes and bodybuilders.

The function of this article is to explore the advantages, usage, and private journey of notable

figures intertwined with the steroid. Many people who use anabolic steroids recreationally

take rather more than is usually used for medical situations.

Length of hospital stay corresponded to solely the first hospitalization taking place inside

30 days after the SARS-CoV-2 check date. Information and definitions relating to the covariates used within the analyses had been published beforehand [74].

However, these Vit D-lowering results of CRTs could

also be countered by the fact that scientific doses of

dexamethasone improve the effects of 25(OH)D3, thus inducing VDR expression in immune cells [64,sixty five,66].

Trenbolone additionally increases IGF-1 considerably, and

HGH will only increase how the muscle responds to all this extra IGF-1.

This is a hardcore cycle for superior users because Tren has some extreme

side effects to cope with. Testosterone will improve muscle mass, reduce

fat, and considerably improve restoration. Mixed with

HGH, these advantages are going to be compounded upon. Gains of 20 lbs

are possible, and water retention must be controllable via food plan (low sodium).

Ladies usually take between 1iu and 2iu every day, just like

feminine medical doses.

Anabolic-androgenic steroids (AAS) are a synthetic form

of testosterone used to increase muscle mass and

strength. They could additionally be dangerous and cause side effects, and the dangers typically outweigh any benefits.

Corticosteroids can treat many causes of irritation in your body.

Some take 100 occasions the dose legally

prescribed for health problems. Corticosteroids are produced within the adrenal gland

positioned above the kidney. These hormones embody aldosterone,

which helps regulate sodium concentration in the body,

and cortisol, which plays many roles in the body, including serving as a half of

the physique’s stress response system to lower

inflammation. Corticosteroids are one other type of steroid naturally produced

in your body to assist regulate inflammatory immune processes.

Cardanolide and bufanolide derivatives, discovered in plenty of plants and

within the skin of toads, trigger vomiting, visual disturbances,

and slowing of the heart in vertebrates and are robust deterrents to predators.

Birds and different predators instinctively keep away from

certain grasshoppers and butterflies that store cardenolides of the plants upon which they feed.

The pores and skin of the poison frog, Phyllobates aurotaenia,

produces a lethal alkaloid, batrachotoxin (14), which is utilized by tribal peoples as an arrow poison. The skin of salamanders secretes a

comparably toxic alkaloid—samandarin (15). For

instance, in the aquatic fungus Achlya bisexualis,

the steroid antheridiol (12) of the feminine stimulates male gamete formation.

You take 6 tablets the primary day after which one fewer each

day for a complete of 6 days. Instead of spreading them out throughout the

times, what is The best steroid for cutting’re you going to do?

You’re going to punch out all 5 and you’re going to swallow them in a single swallow, very first thing within the morning.

But there are necessary nuances about taking any steroid, whether prednisone

or the Medrol Dosepak that folks just don’t know.

To assist prevent prednisone withdrawal symptoms, an individual should taper the quantity of the

medicine slowly and under the steerage of

a doctor.

“I had an additional 10lbs of lean muscle – we did a pretty good job with my coach in that brief period of time to get used by my new strength and weight within the water. It was a very good result.” The Improved Games – a controversial new occasion which promotes banned performance-enhancing medicine – says considered one of its athletes has crushed a long-standing

world document. Your HGH results will be made

or damaged by the standard you ought to purchase. Once More, this comes down to

price and the power to source LEGITIMATE or top-quality generic HGH kits (of which there are very few).

In the golden era of bodybuilding, outstanding

figures like Arnold Schwarzenegger and Ronnie Coleman have sculpted

wonderful bodies that stand as testaments to the potential of human physique.

And inside their toolbox, apart from the sweat and iron,

lurked Dianabol. Here’s an in depth take a glance at their routine, which – at least rumor has it – included this well-known anabolic

steroid.

Such a practical read.

You’re going to wish to undergo a full

8 to 12 weeks cycle to get the most effective outcomes out of this authorized steroid, too.

Many of those natural supplements have testosterone-boosting components that happen naturally in meals and nature.

These natural steroids remove the necessity to fear about the authorized status, breaking legal

guidelines, or acquiring a sound prescription as they are readily available over

the counter in most nations. Girls are typically less inclined to

make use of steroids because of the threat of creating pronounced

male characteristics, such as a deeper voice and increased

physique hair [5]. Deca Duro also helps in lowering joint

pain and irritation, which is a typical drawback amongst athletes and bodybuilders.

The greatest a part of Deca Duro is its security profile, as it’s a natural supplement and doesn’t trigger any harm to the body.

General, when you’re in search of a potent muscle-building

complement that’s both protected and effective, Anadrole is amongst the prime picks on the market.

Annihilate is simply laxogenin and it’s considered to be one

of the best plant based steroid for power and restoration. You need to take around 200mg of whole epicatechin per day to maximize the outcomes and if you want to maximize the outcomes, you possibly can take it with pure anabolic supplements like Enhance, Annihilation or

Arachondic. However the spotlight shines on epicatechin for its capacity to inhibit myostatin,

a muscle development regulator that stops muscular tissues from

rising too quick or too massive. Nonetheless, evaluations seem to

agree that this plant steroid, laxogenin, can increase energy with only 100mg per day.

Big Diet is properly trusted in relation to supplements as they test their ingredients for purity to make sure the content material of extracts.

However, in other nations or areas, authorized steroids could fall beneath the class

of managed substances or require a prescription. This

signifies that they’ll only be obtained by way of a healthcare professional’s recommendation or underneath specific circumstances.

In such circumstances, possession, purchase, or use with out proper authorization could also be illegal.

Anabolic steroids are extensively utilized in weight training to considerably boost

lean muscle mass. My experience with athletes exhibits

that elevated muscle mass usually leads to enhanced energy and a competitive

benefit in sports. Legal steroid drugs and capsules work by delivering a mixture

of pure components to your physique that can mimic the results of anabolic injectable steroids list, without the harmful

unwanted effects. This legal steroid various

is made with premium ingredients that work together to create an anabolic surroundings in your body.

The possession, use, and distribution of steroids with no prescription is a federal crime in the Usa.

The penalties for violating steroid laws range relying on the specific circumstances of the case, but they can be severe.

However, the reviewers notice that these products are difficult to study and compare as companies are protecting of their individual ingredient blends.

Completely Different supplement manufacturers contain a

diversified mixture of the above ingredients. Nonetheless, the

precise quantities of each ingredient are not always clear as firms usually are not

open about their formulation.

Instead of forcing athletes to cheat in secret and without proper guidance, this model encourages

open, scientifically monitored enhancement.

Critics warn that normalizing PEDs sends the mistaken message, especially to

youth. The concern is that the Games may glamorize doping, causing a ripple impact that results in more young athletes

engaging in unsafe or unsupervised drug use in hopes of replicating elite performance.

With backing from Silicon Valley billionaire Peter Thiel, Donald Trump Jr., and other controversial figures, the Games

have generated large media coverage and capital.

Ergogenic dietary supplements are substances that enhance the body’s capacity to produce power.

By the mid 1980s issues about anabolic steroids in each

professional sports and amongst lay customers was rising in strength.

Individuals have been involved that spurred on by their favorite athlete, teenagers and adults have been wanting toward chemical enhancement for purely leisure functions.

The Johnson banning was the straw that broke the camel’s back for

the American media and within the ensuing frenzy following the Canadian’s suspension, Congress was heavily lobbied to examine the utilization of steroids.

The Worldwide Society of Sports Activities Vitamin found that

creatine is a extremely effective complement for rising performance and lean physique mass when training.

When used with resistance training, as most athletes do, you probably can expertise swelling of the heart muscle,

leading to high blood pressure. Other unwanted facet effects embrace liver harm,

aggressive habits, and fertility issues.

As of 2021, SARMS are not accredited by the Food and Drug Administration (FDA) for medical

use, however they aren’t explicitly illegal. They are often offered as dietary supplements, although the FDA has issued warnings about this, stating that they have

the potential for critical unwanted side effects and that they need to be averted by members of the public.

Moreover, the FDA has sent warning letters to corporations selling SARMS as dietary supplements, expressing concern about potential

liver injury, cardiovascular dangers, and different unwanted effects.

Anytime you are concerned with an unlawful steroids or human development

hormone felony investigation, you have to communicate to a felony protection attorney earlier than you speak to the police or

investigators. Even when you have no purpose to believe you have accomplished anything mistaken, you’ll

be able to expose your self to prosecution as quickly as you communicate to the police with out the recommendation of an experienced attorney.

State and federal legislation acknowledges that human growth

hormone and anabolic steroids are medically useful, meaning a well being care provider can prescribe them to a patient in some situations.

However, physicians, pharmacists, and others who present prescription medicines

can be charged with steroid crimes, particularly when they operate, or are connected with, so-called “tablet mills.”

I really valued the approach this was explained.

The big volume of mail makes it difficult, but these companies monitor and attempt to intercept parcels from addresses

identified to be connected with steroids. One teen’s combination of four steroids for

one “stack,” consisting of two injectables and two drugs, price $800.

Our evidence-based therapies include Cognitive Behavioral

Therapy and eye movement desensitization and reprocessing.

Remedy additionally entails the utilization of expertise and strategies that will help

you energy through life. We give residents various choices in accommodations that

range from normal to luxurious. If you’re looking for a extra holistic or faith-based treatment program, we additionally offer

those.

Primarily used by younger folks, inhalants that can be

abused include many on a daily basis family merchandise, together with gasoline, cleaners, glues, paints, and solvents.

In fact, this straightforward availability makes inhalants the fourth-most abused substance in America.

In teens, use of nicotine could trigger modifications to the development of

the components of the mind that management attention and learning.

Different risks embody temper disorders, and problems with

impulse control. U-4770 is an illegally made artificial (lab-made) opioid that is about 7.5 instances the strength of morphine.

In teens, tobacco use might trigger adjustments to the development

of the elements of the brain that management attention and learning.

Dissociative drugs can make people really feel disconnected from their

body and surroundings. Consuming products containing delta-8-THC has led to medical emergencies, together with

respiration and psychiatric problems. These merchandise are largely unregulated,

and different product elements or contaminants might also have unpredictable negative health results.

Methadone, buprenorphine, and naltrexone are all FDA-approved medications to treat opioid

use dysfunction (OUD). An overdose could be reversed

if overdose reversal medicines, together with naloxone (sometimes bought as Narcan®)

are given quickly. Individuals who use benzodiazepines could develop a substance use disorder.

Remedies might embody behavioral therapies, hormone therapies,

and antidepressants. Anyone discovered to be selling or supplying anabolic steroids illegally might be fined as much as €2,000 or receive a jail sentence.

Utilizing cocaine with anabolic steroids has been known to reinforce the results – and unwanted facet effects – of both drug.

These teams have alternative ways of working in the body, with

the main distinction being corticosteroids are catabolic (breakdown) and anabolic steroids promote growth (are anabolic).

As elite athletes are caught dishonest through the use of anabolic

steroids, maybe their notion as positive role fashions will fade and using steroids decrease.

Increased stress to test athletes at younger ages could lower the use

of steroids as well.

Depo-Testosterone is an instance of the injectable testosterone ester.

AAS abusers additionally use veterinary products, corresponding to Finajet and Equipoise, that

have been devised for animal usage. The first artificial variations of testosterone

had been created by European researchers quickly after 1935, the 12 months testosterone was first isolated in laboratories.

Intended for medical reasons, AASs have been devised

to assist individuals rebuild body tissue lost through illness.

In fact, after World Warfare II ended in 1945, AASs

got to many ravenous focus camp survivors to assist them add skeletal muscle and gain physique weight.

For instance, in the Nineteen Sixties AASs have been used

to treat the lowered peak (also called brief stature) that occurs in a situation referred to as Turner syndrome.

Then human growth hormone grew to become out

there and changed using AASs for this condition.

Ayahuasca use has been linked to psychological well being

issues like anxiousness and depression. Nevertheless, Schedule IV medicine are safe and effective when used as prescribed.

As such, they play an necessary position in treating numerous medical circumstances.

However, these substances even have an accepted medical use and

can be prescribed by a licensed doctor. The agency can also place drugs into “emergency schedules”

if they pose a major public health menace.

The twenty-first century has seen the extent of anabolicandrogenic steroid

abuse lower. The agents also uncovered the names of professional athletes

in a quantity of sports who had obtained products from BALCO by way

of personal trainers or different suppliers. In 1975 the Worldwide Olympic Committee banned use of all

anabolic-androgenic steroids and began a testing coverage to maintain steroid

users out of the Olympics. If athletes knew the check date ahead

of time, they might cease best steroid cycle for bulking (lusitanohorsefinder.com) use beforehand.

This would give them sufficient time to wash their methods of the drug and keep away from

detection.

It belongs to a gaggle of drugs called psychedelics or hallucinogens.

They have the potential to change a person’s sense of actuality, main them to see, hear, and really feel issues that

aren’t happening in actual life, or to experience reality differently.

PCP (phencyclidine), or “angel dust,” is a synthetic (lab-made) dissociative drug developed as an intravenous (I.V.) anesthetic that has been discontinued as a outcome of serious adverse

health effects. Methadone, buprenorphine, and naltrexone are all FDA-approved drugs to deal with opioid use disorder.

Halcion (triazolam) usually goes by the

identical road names as Ativan. The FDA has carefully examined the commercialization and utilization of specific peptides and steroids, expressing apprehensions about their security and the absence

of approval for numerous substances. Comparable to 7-KETO DHEA, B-AET does not suppress the HPTA

and promotes fats loss by inhibiting cortisol. Based Mostly on private expertise, B-AET presents superior outcomes in comparison with 7-KETO DHEA.

Gyms might provide in-house dietary supplements with professional advice, while Walmart,

Costco, and drug shops also present quite lots of options.

Contemplate the possibility of long-term unwanted effects with the common use

of workout supplements. While most multi-ingredient supplements are generally secure and pose

a low risk of main side effects, few studies look at their impact over an prolonged period.

Clenbutrol mimics Clenbuterol by inflicting thermogenesis in the

body (increased heat production). As a result of this,

the physique has to continually cool itself down to make sure

the body’s temperature doesn’t rise excessively. In our experience, using

Decaduro alone is not going to yield vital muscle features.

Thus, for maximum muscle hypertrophy, stack Decaduro

with D-Bal, Anadrole, Trenorol, and/or Testo-Max.

With Magnum Prescription Drugs, you’ll find a way to confidently select their merchandise for optimum performance enhancement.

Buying steroids online with delivery turns into

probably the most feasible option for many individuals in Australia.

If you’ve been suggested to buy a “authorized alternative” as an alternative of a real steroid,

always do your research first.

Some information has instructed that on a milligram for milligram foundation, Dianabol is definitely the stronger steroid.

Commonplace Dianabol doses will range tremendously depending on expertise and individual desires.

Regardless Of internet rumor and myth, a quality Dbol

pill will produce notable outcomes with as little as

15mg per day.

And even if you’re not one of these individuals, there are nonetheless specific

guidelines you must follow to ensure safe steroid use.

Injecting hormones instantly into the physique is a really quick and environment friendly approach to administer

them without risking injury to the liver. But raising hormone levels

too rapidly can cause uncontrollable points.

This is not simply any article; it is your guide to creating safe choices about your well being.

Right Here, you’ll discover tips to stop you from wasting cash on things that do

not work.

Our lab-made melatonin products supply a pure tan, better sleep,

and a bunch of well being benefits. Experience the method forward for health with our Human Development Hormones (HGH) choice.

Uncover the key to lean muscle gains, enhanced fat metabolism,

and improved overall vitality. Our HGH products are your ticket to reaching peak efficiency and

vitality. Unlike another in style dihydrotestosterone

derived anabolic steroid in Anadrol, Anavar is what we’d name a quite aspect

effect friendly anabolic steroid. Facet effects

are actually potential, however for the wholesome

adult they can be minimized. In truth, with accountable use,

many will discover they experience no unfavorable results in any respect.

Anabolic pills like steroids (deadheadland.com) are

broadly obtainable within the United States, so anybody can easily

get their hands on them. We designed this guide within the hopes of constructing your Trenbolone purchases

that bit simpler. Tren-E 200 by Magnum Prescribed Drugs is one other trusted Tren Enanthate

product that is celebrated for its vital influence and

dependability. Tren-E by Magnum stamps its mark within the competitive

world of Trenbolone Enanthate. When choosing a dependable Trenbolone

supplier in Australia, hold this guidelines helpful to make sure you’re making a clever decision. Look for suppliers who give secure payment selections